Welcome back to another edition of New Economies which is rooted in my experiences working in venture. We’re living in extraordinary times—the most exciting era ever in technology, with groundbreaking trends emerging constantly that will redefine how we live and work in the future.

Join me on this journey—subscribe to New Economies to stay ahead of the curve in technology. We’re just getting started!

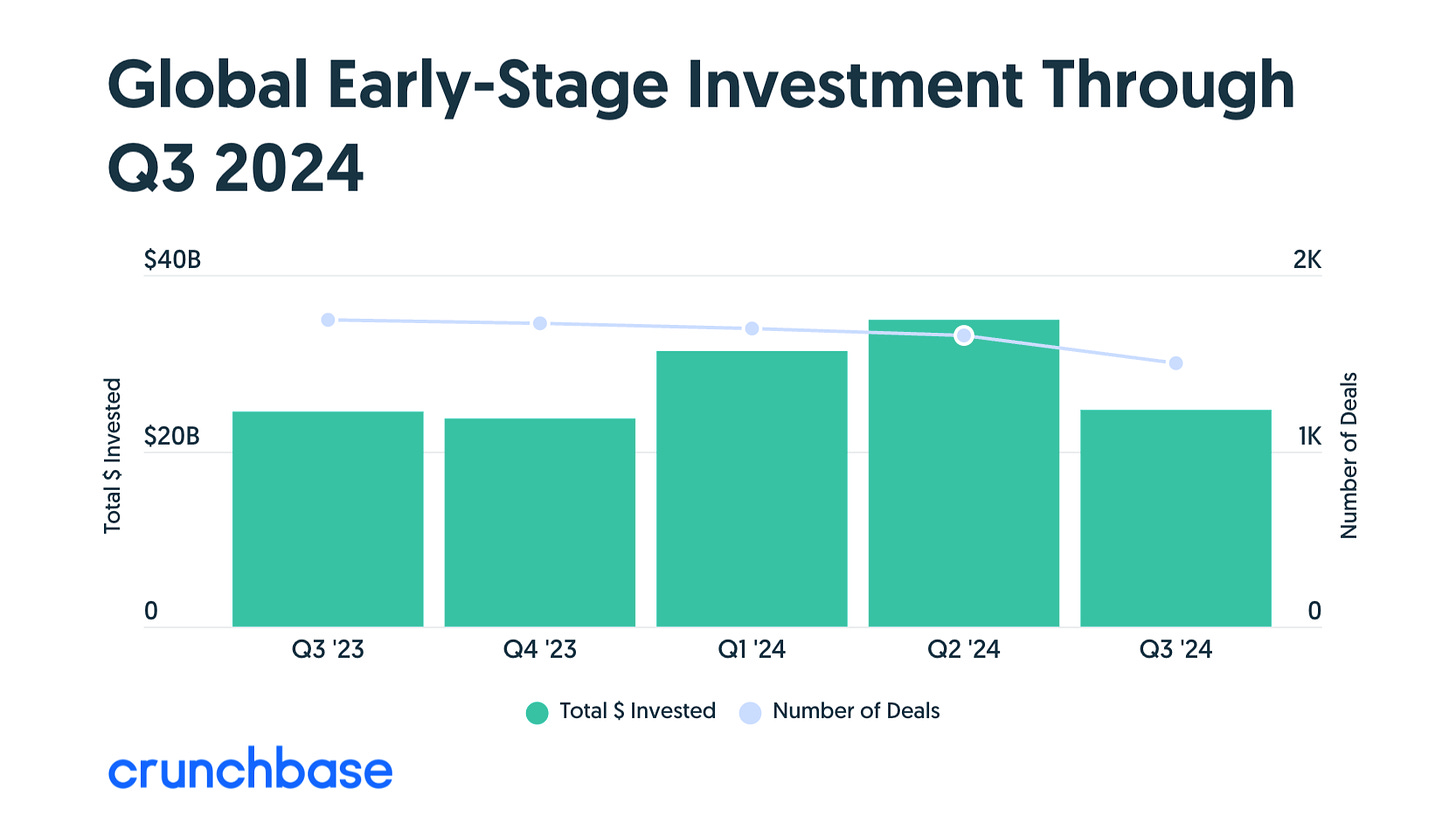

The number of new startups is at an all-time high, with thousands raising $24.7 billion globally in Q3 2024—and 30% of this funding went to AI startups.

We believe now is the best time to build a startup, given we are witnessing one of the greatest technology shifts of our generation. Talent is abundant, founders can assemble teams from anywhere in the world, and you can lay the groundwork for your startup with minimal investment, as we covered in The Startup Tech Stack which we published earlier this year.

During my time in venture, working with hundreds of startups, founders often shared how challenging it can be to find the right investors. Recognizing the time it takes to create prospect lists, we took it a step further by creating one of the most comprehensive databases of active investors—covering global, local, and industry-specific investors—The Ultimate Investors Handbook for Startups.

Types of Investors

For those new to startups, there are typically five different types of investors:

Angel Investors: Private individuals investing their own capital.

VC Funds: Teams investing other people’s money with the hope of delivering very good returns. This can also include accelerators.

Family Offices: Families who have accumulated major wealth.

Corporate Innovation Arms (CVCs): These investors are typically corporates investing directly from their balance sheets.

Institutional Investors: These include endowments, private equity firms, and other large financial institutions.

Knowing the different types of investors is just the first step. The next challenge is finding investors who are actively looking to support startups like yours, whether regionally, globally, or within specific sectors. That’s where our Ultimate Investors Handbook for Startups comes in.

The Ultimate Investors Handbook for Startups

Finding the most up-to-date investors who are actively investing locally, globally, and in specific sectors can take many hours of research. That’s why we’ve spent hundreds of hours writing The Ultimate Investors Handbook for Startups which includes thousands of investors who are actively investing.

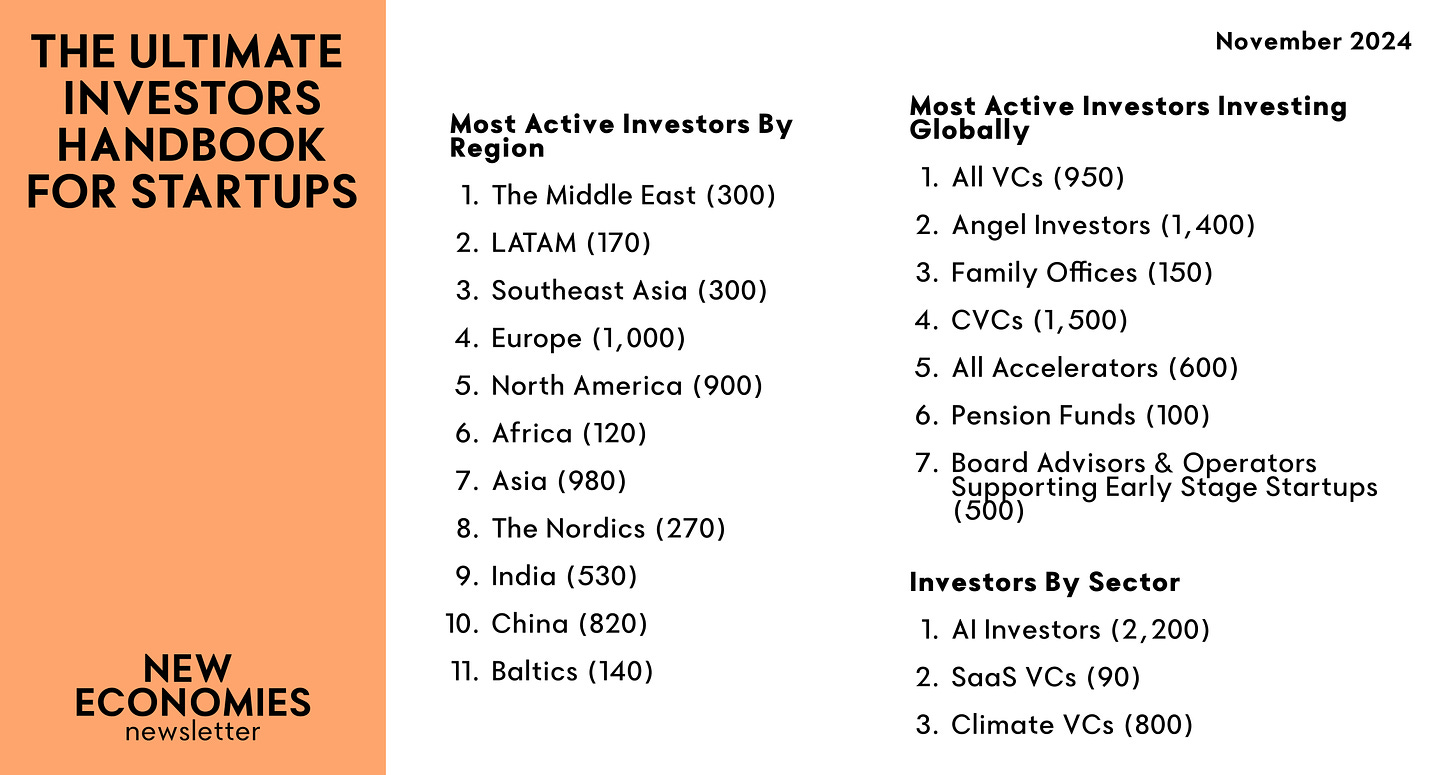

Throughout this handbook, you will find the following resources:

*The number in brackets indicates the number of investors in our database.

The Most Active Investors by Region

You can find the following investors by region who are investing agnostically:

The Middle East (300)

LATAM (170)

Southeast Asia (300)

Europe (1,000)

North America (900)

Africa (120)

Asia (980)

Nordics (270)

India (530)

China (820)

Baltics (140)

The Most Active Investors Investing Globally

The following investors are investing globally:

All VCs (950)

Angel Investors (1,400)

Family Offices (150)

CVCs (1,500)

All Accelerators (600)

Pension Funds (100)

Board advisors & operators supporting early stage startups (500)

The Most Active Investors Investing by Sector

The following investors focus on investing in these sectors:

Most active AI Investors (2,200)

Most active SaaS focused VCs (90)

Climate focused VCs (800)

Thank you for reading. If you enjoyed this edition, click the ❤️ at the top of this post to help the handbook travel far and wide!

Upgrade to become a premium subscriber and receive:

Complete access to The Ultimate Investors Handbook for Startups for you and a friend.

Complete access to The Ultimate Startup AI Handbook

Complete access to our data room, which includes thousands of startups and investors.

Are you a creator and looking for new sponsors? Subscribe to access our data room which includes hundreds of platforms sponsoring creators.

The Operator’s Handbook: All the resources to launch your entrepreneurial career.

$1 million in discounts at HubSpot, Notion, and other platforms.

Full access to all New Economies newsletter editions.