Hey Readers 👋

Welcome to New Economies, where we discover and share the latest technology trends shaping our world. In this edition, we share the latest developing insights in VC: the growing trend of former founders and operators starting their own venture funds and the impact this shift is having on the startup ecosystem.

When founders or early operators from prominent tech companies exit, some choose to launch their own VC funds, leveraging their extensive experience to reinvest in the ecosystem. These solo GPs often specialise in a particular domain or sector and typically raise between $10M and $50M, though amounts can sometimes be higher, for their inaugural fund.

In this edition of New Economies, we learn:

What are Solo GPs

Why you should include one on your cap table

The Solo GP landscape: Mapping 120+ investors

Let’s dive in!

The impact of Solo GPs

Over the last few years, we have seen a number of former founders and operators launching their own micro funds for example, Rex Salisbury, a former investor at Andreessen Horowitz launched his own Fintech fund, Cambrian. You have the likes of Rex Woodbury, a former investor at Index Ventures who recently launched Daybreak Ventures, then you have the likes of fellow Substacker, Packy McCormick who launched Not Boring Capital. Their funds are normally much smaller than traditional funds, which allows them to be more agile and edgy. These are just a few examples and there are hundreds of others that you should know about.

Key facts

Source

In recent years, the number of micro VCs has surged by 120%, with approximately 58% based in the US.

Micro VCs invest 70% of their allocated funds into seed and early-stage startups.

Types of investors for founders

Raising capital from investors can make or break a startup; it's exhilarating yet incredibly challenging. You'll hear far more 'nos' than 'yeses.' While new funds are launching almost weekly, they're becoming much more niche, focusing on one sector, domain or geography. This trend benefits solo GPs, who often have established brands and strong industry connections, enabling them to access the pool of startups raising within their thesis.

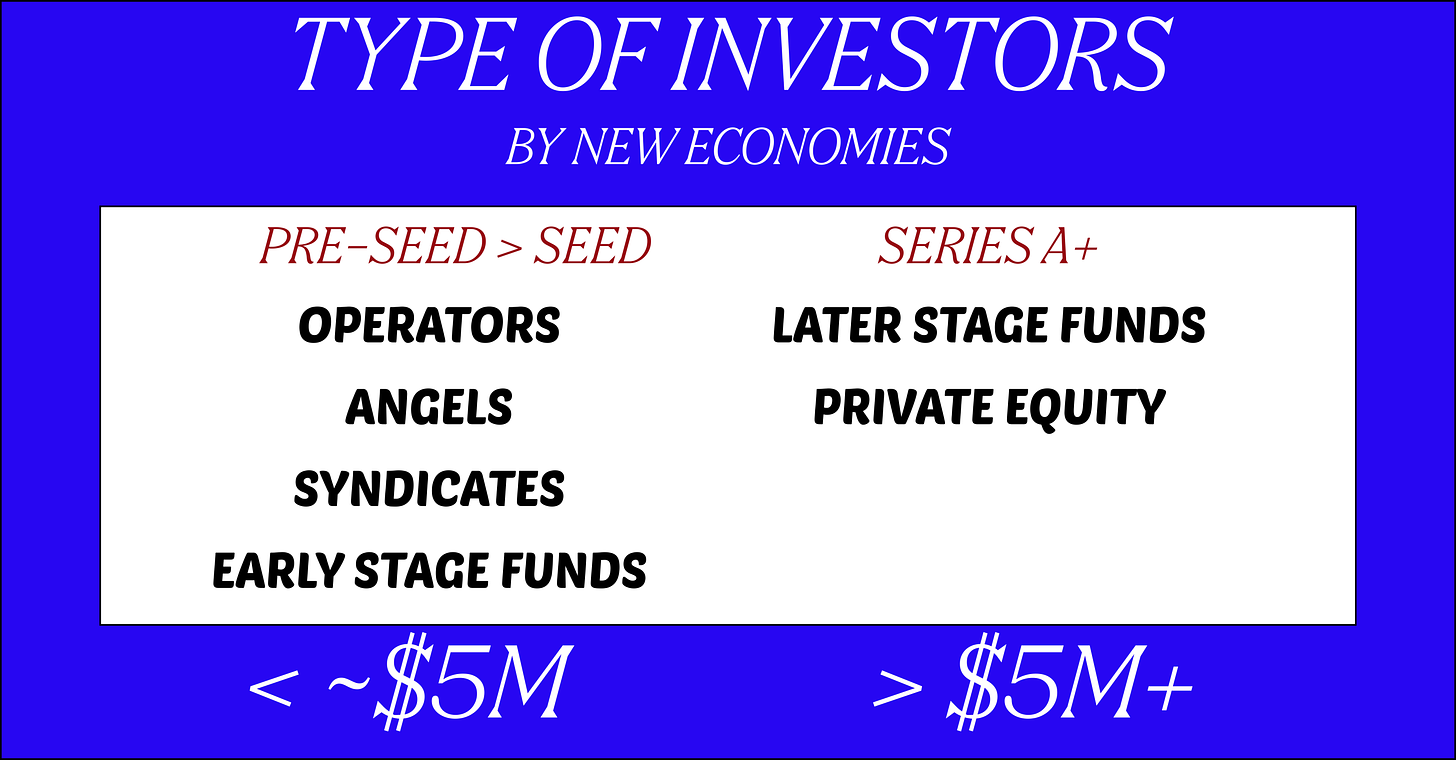

When founders go out to raise, they can approach various types of investors. Early-stage startups typically engage a blend of operators, angel investors, early-stage funds, and sometimes angel syndicates. As these startups progress and raise additional funding, their investor base usually evolves to include later-stage venture funds, as well as growth funds, and eventually private equity firms.

Why you should consider a Solo GP on your cap table

One advantage of including a solo GP on your cap table is their ability to make investment decisions quickly. Unlike traditional VCs, who need to consult with their fellow partners for approval, solo GPs can typically decide within a few days.

Additionally, solo GPs often specialise in a particular stage or, more interestingly, a specific sector. Those focusing on a single sector are usually former operators with deep industry expertise and strong connections. These types of solo GPs also have some of the following characteristics:

They are well networked

Given their niche, they are likely well positioned to open valuable doors for you. These GPs have spent years building their rolodexes of connections so if you pick the right investor, they should be able to connect you with industry leaders. They will also be connected with most of the leading VCs within their area of focus, making it easier to open doors for subsequent funding rounds.

*Tip* - Should you land a term sheet from one of these GPs, ask them for introductions to potential investors and customers.

They have more time to help you

As you may know, typical venture funds who invest in pre-seed to seed, most likely have $50M to $500M under management, meaning they need to invest in a lot of startups just to make a return. Unlike solo GPs, they will most likely have much smaller funds ranging from $10M to $50M, allowing them to spend more time with you.

Greater flexibility in terms

Solo GPs typically offer more flexibility in their investment focus and deal terms. They are often more willing to invest in unconventional or niche markets and may be open to negotiating terms that are more favorable to the founder.

The Solo GP landscape

Throughout this market map, we discover 60+ solo GPs who are Generalists or experts across: AI, Consumer, Crypto & Fintech, Impact, Deeptech, Health and SaaS.

Disclaimers:

These funds appeared to be operating at the date of this publication

The investors have been categorised based on how they describe themselves on their website. They may also invest in additional categories.

Upgrade to access the data in full. By upgrading, you also receive:

120+ Solo GPs: Sector and geography they invest in, stage, cheque size, fund size and more

Dataset of LPs who are investing in Solo GPs and which fellow GPs they have invested in

$1M in free discounts at the likes of Hubspot, Notion, Datadog and others

Join our exclusive Slack community

Access to our data room: Hundreds of early stage startups added each week

Trends for Solo GPs and what we might expect in the near future

And more!

Hope you enjoyed this edition. If you did, let me know by giving it a ❤️

See you next time!