Welcome back to another edition of NEW ECONOMIES, rooted in my experiences working in venture. From inside the venture world, one thing is clear: we’re not just in a tech boom—we’re living through a full-blown economic rewrite. New platforms, new business models, and evolving public market strategies are reshaping everything.

Join us on this journey—subscribe to NEW ECONOMIES to stay ahead of the curve. We’re just getting started.

THIS WEEK’S SPONSOR: ATTIO

Attio is the CRM for the AI era. Connect your email, and Attio instantly builds your CRM—with every company, every contact, and every interaction you’ve ever had, enriched and organized.

You can also build AI-powered automations and use its research agent to tackle some of your most complex business processes, freeing you to focus on what matters the most: building your company.

Join industry leaders such as: Flatfile, Replicate, Modal, Union Square Ventures and more. Try the CRM that’s built for the future—loved by customers.

When I first opened Attio, I instantly got the feeling this was the next generation of CRM.

—Attio Customer.

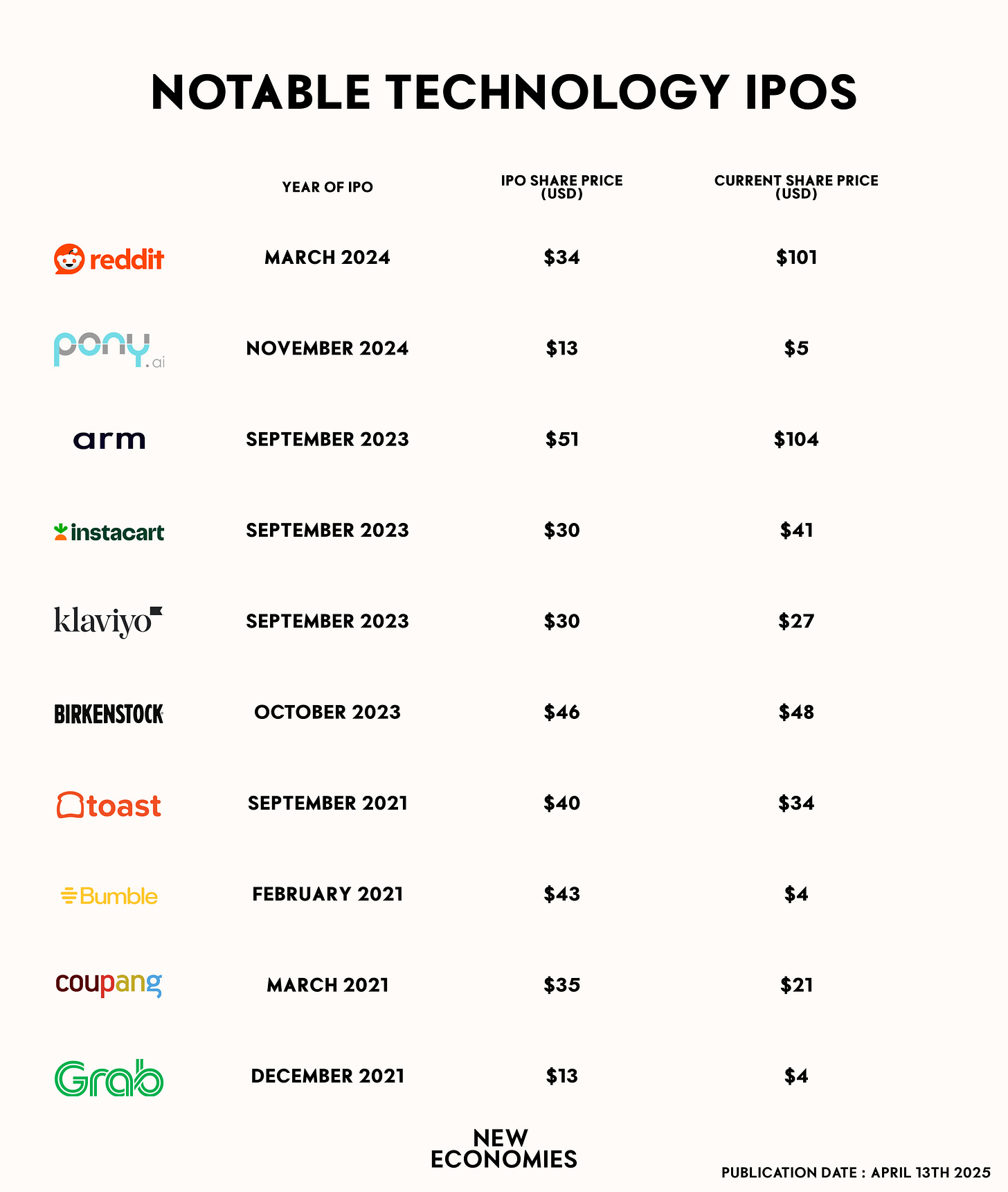

Following our recent coverage on Microsoft turning 50, we’re back with something big: a deep dive into the IPO market. We’ve curated 50 must-read IPO prospectuses—a one-stop resource to understand which companies have gone public in recent years, where they are now, and which ones are preparing for public listings in 2025–2026.

THIS EDITION COVERS:

The current state of the IPO market – A curated list of companies that went public in recent years—and where they are now.

The Watchlist – A forecast of the most anticipated IPOs for 2025–2026: think Stripe, Chime, Databricks, and Klarna.

The Data Room – Read 50+ IPO prospectuses from the companies you know and love.

THE CURRENT STATE OF THE IPO MARKET

The IPO market has slowed significantly due to heightened volatility and global economic uncertainty. A major trigger was the April 2025 market crash, following a surprise wave of U.S. tariffs announced by President Trump. The move sent the Dow Jones plunging and rattled investors worldwide.

This turbulence has paused IPO plans across the board, even after a strong start to the year. Klarna, StubHub, and 1Komma5 have postponed their listings, waiting for more stable conditions. Analysts note the VIX (volatility index) has surged above normal levels, signaling that investors remain too cautious to support new offerings.

The hesitation extends beyond the U.S.—major IPOs in London and elsewhere have also been shelved. Until there’s more clarity around interest rates, trade policy, and overall market direction, most IPO hopefuls are likely to remain on the sidelines. Even if conditions stabilize, companies may be forced to offer discounts to attract buyers, making IPOs less appealing. Instead, many late-stage startups are turning to secondary markets to access liquidity.

IPO WATCHLIST: 2025 & 2026

These are the most closely watched companies on the path to IPO—and they should be on your radar too:

STRIPE

Founder(s): Patrick Collison, John Collison

What they do: Stripe is a technology company that builds economic infrastructure for the internet, providing payment processing software and application programming interfaces for e-commerce websites and mobile applications.

Why they might go public: As of February 2025, Stripe's valuation has risen to over $90 billion, driven by increased demand from AI companies. The company has been profitable for two years and processed $1.4 trillion in payments in 2024, a 40% increase from the previous year. Despite this growth, Stripe has chosen to invest profits back into research and development rather than rushing towards an IPO.

CHIME

Founder(s): Chris Britt, Ryan King

What they do: Chime is a financial technology company that offers fee-free mobile banking services, including checking accounts with no overdraft fees, early direct deposit, and an automatic savings feature.

Why they might go public: Chime confidentially submitted a filing for an initial public offering (IPO) in December 2024, targeting a 2025 public debut. The company aims to capitalize on its growth and expand its market presence.

DATABRICKS

Founder(s): Ali Ghodsi, Matei Zaharia, Reynold Xin, Ion Stoica, Patrick Wendell, Andy Konwinski, Scott Shenker

What they do: Databricks is a data and AI company that offers a unified data analytics platform, enabling data engineering, machine learning, and analytics across various industries.

Why they might go public: Databricks raised $10 billion in a funding round in December 2024, bringing its valuation to $62 billion. The company plans to generate $3.8 billion in revenue and is considering an IPO in 2025 to further its growth and market reach.

KLARNA

Founder(s): Sebastian Siemiatkowski, Niklas Adalberth, Victor Jacobsson

What they do: Klarna is a fintech company offering buy-now-pay-later (BNPL) services, allowing consumers to make purchases and pay for them over time with interest-free installments.

Why they might go public: Klarna filed for an IPO in March 2025, aiming to list on the New York Stock Exchange under the symbol "KLAR." The company seeks to leverage its growth and profitability to attract investors.

DISCORD

Founder(s): Jason Citron, Stanislav Vishnevskiy

What they do: Discord is a communication platform designed for creating communities, offering voice, video, and text chat, primarily used by gamers but expanding to other communities.

Why they might go public: Discord is in early-stage talks with investment bankers about a potential IPO, aiming to capitalize on its growing user base and expand its services.

IMPOSSIBLE FOODS

Founder(s): Patrick Brown

What they do: Impossible Foods develops plant-based substitutes for meat products, aiming to provide sustainable and environmentally friendly food options.

Why they might go public: The company has been considering an IPO to raise capital for expansion. CEO Peter McGuinness stated that they are exploring options to raise funds, including a potential IPO.

NETSKOPE

Founder(s): Sanjay Beri

What they do: Netskope is a cybersecurity company that provides cloud security solutions, including data protection and threat defense for cloud applications, data, and infrastructure.

Why they might go public: Netskope plans to go public in the second half of 2025, aiming to leverage its growth and position in the cloud security market.

SHEIN

Founder(s): Chris Xu

What they do: Shein is an online fast-fashion retailer offering a wide range of clothing, accessories, and beauty products at affordable prices.

Why they might go public: Shein has confirmed plans to pursue an IPO, with London appearing to be the preferred location. The company aims to raise funds to support its rapid growth and expansion.

FANATICS

Founder(s): Michael Rubin

What they do: Fanatics is a global leader in licensed sports merchandise, offering a wide range of apparel, jerseys, and other fan gear for various sports teams and leagues.

Why they might go public: Fanatics has been moving closer to an IPO, aiming to capitalize on its dominant position in the sports merchandise market and expand its product offerings.

These companies are closely watched for their potential public offerings in 2025 and 2026, as they look to leverage their growth and market positions to access public capital markets.

SO, WILL COMPANIES STAY PRIVATE LONGER?

Going public is a defining milestone, but timing is everything. With so much uncertainty, many startups are asking whether they’re better off staying private longer—or weathering the storm and going public anyway.

Whether you're a founder, investor, or creator, IPO filings are more than financial docs—they're blueprints for scaling a company. They reveal how businesses tell their story, position their risk, and articulate their future. There’s a lot to learn, and it’s just a few clicks away.

UPGRADE YOUR NEW ECONOMIES SUBSCRIPTION TO ACCESS 50+ OF THE HOTTEST PUBLIC COMPANIES—READ THEIR FULL IPO PROSPECTUSES NOW.

If you're enjoying reading New Economies, help this edition reach more readers by clicking ❤️ and 🔄 at the top of this post.