Over the next few decades, the wealth management industry is expected to experience a transformative shift.

Hey Readers 👋

Welcome to this week’s edition of New Economies, a newsletter exploring the latest technology trends shaping our world.

In this edition, we’re excited to feature Marine Augé, Investor at Fidelity International Strategic Ventures who helps us understand the innovation and changes which are taking place across the wealth management space.

Let’s get started!

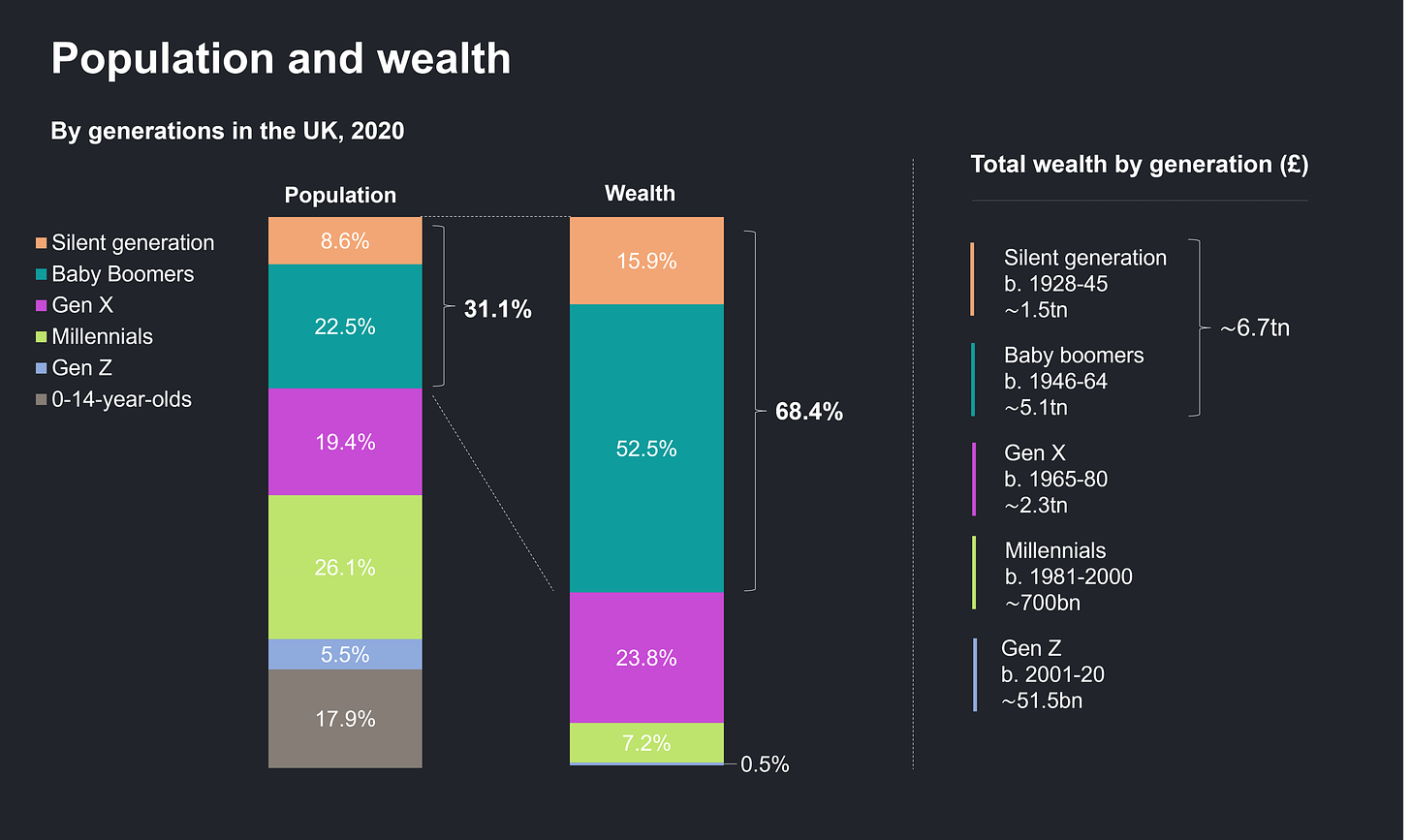

In the United States alone, an estimated $84 trillion will change hands, primarily moving from Baby Boomers to Millennials and Gen Z (while Boomers will only inherit up to $12 trillion). This unprecedented ‘Great Wealth Transfer’ presents a massive opportunity for the industry, but also brings significant challenges, particularly for traditional firms struggling to keep up with modern demands.

Many traditional wealth management firms are caught at a crossroads, struggling with legacy technology, and ever evolving client expectations. These cumbersome systems are expensive to maintain and lack the flexibility needed to keep pace with modern market demands. Today, nearly 50% of wealth management firms report that their technology platforms are not fully integrated. This lack of integration leads to inefficiencies, higher operational costs, and ultimately higher fees for clients. Additionally, these outdated systems often rely on manual processing, limiting scalability and slowing down service delivery.

At the same time, client expectations are evolving rapidly. Simultaneously, shifting client demands render traditional face-to-face advisory models increasingly obsolete, especially among younger clients who opt for digital tools offering real-time access, personalised insights, and a seamless experience across devices. In fact, 70% of Millennials now manage their wealth digitally, and 70% of Millennials and Gen Z are likely to change advisors after inheriting wealth, choosing modern, tech-enabled financial services.

Responding to these challenges is a new wave of start-ups, bringing fresh ideas and innovative solutions to the financial services space. These companies are harnessing AI, blockchain, and big data analytics to build platforms that are not only more efficient and cost-effective but also better aligned with the needs and expectations of today’s consumers.

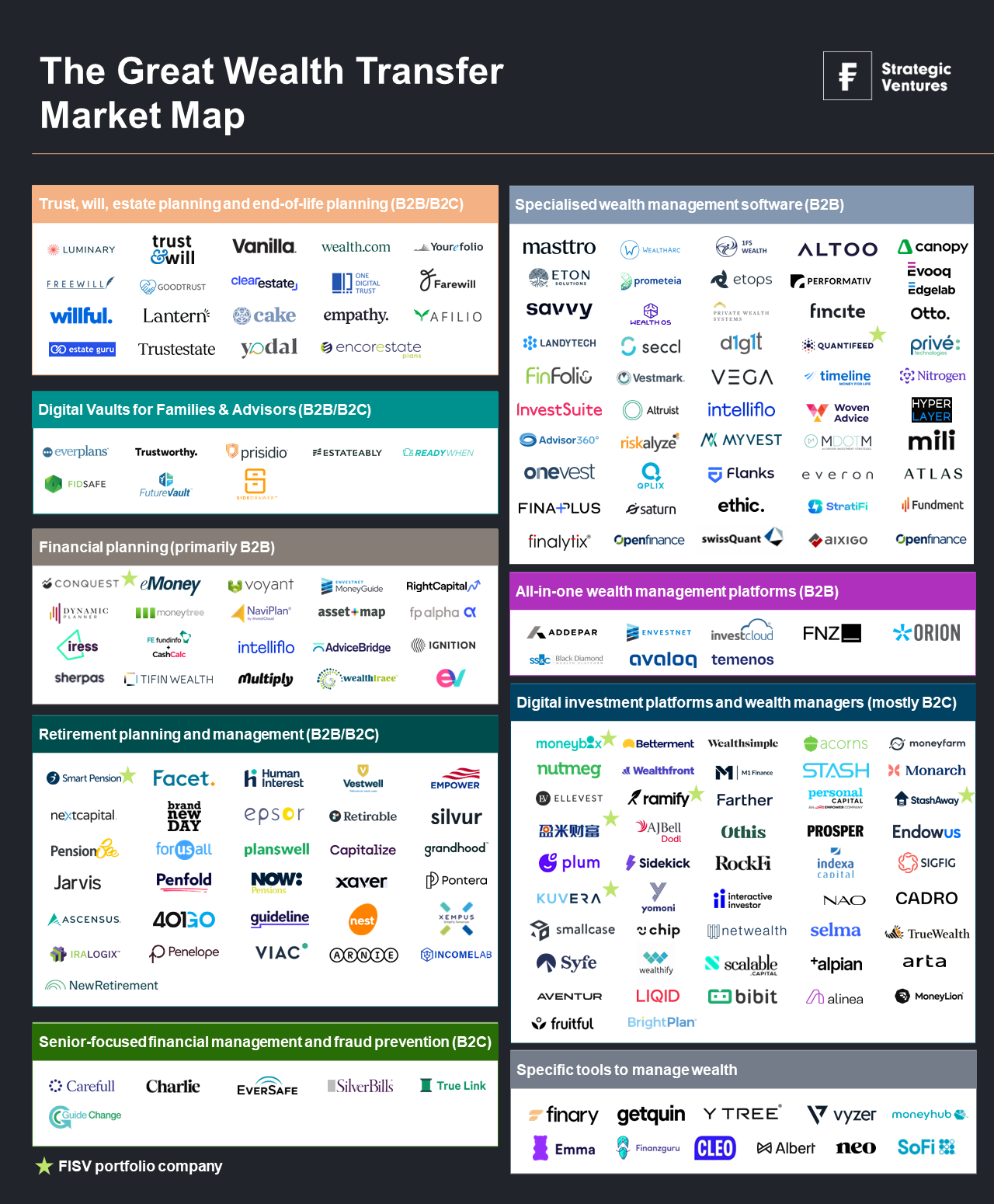

Introducing our wealth transfer market map:

To help navigate this evolving landscape, we’ve created a market map that highlights the key players in the wealth transfer space. Our map explores both the innovative start-ups poised to support not just the younger beneficiaries inheriting wealth but also the older generations preparing to pass on their finances. Each group presents a host of unique challenges and opportunities, which we unpack in full below.

At Fidelity International Strategic Ventures (FISV), we’re already investing in the companies innovating for this shift. Our portfolio includes a range of innovative companies globally, such as Conquest Planning, Moneybox, Moonfare, Smart Pension, StashAway, Ramify and Yingmi. If you’re building in this space or know a company, we’ve missed off this map, then we’d love to hear from you!

Key Trends & Emerging Solutions

1. Serving the elderly – the retirees

The number of people aged 65+ in the US is projected to rise from 60 million today to 100 million by 2060 (U.S. Census Bureau’s Population Projections). This demographic shift presents significant opportunities to develop digital-first solutions for a tech-savvy generation entering retirement. We are already seeing the beginning of this trend, with innovative solutions emerging to meet the specific needs of the 55+ demographic, particularly in three key areas:

Ensuring longevity financing: As life expectancy continues to rise, retirees face the challenge of ensuring their financial resources stretch over ever lengthening retirement periods. The pension market, long overdue for disruption, is being reimagined by companies like Guideline and Smart Pension, which offer digital retirement planning solutions to help retirees manage their wealth long after they’ve left the workforce.

Managing and protecting older people’s finances: With age comes vulnerability, the risk of financial fraud among the elderly is alarmingly high, with older Americans losing an estimated $1.7 billion to fraud in 2021 alone. In response, companies like Carefull and Charlie are emerging to safeguard seniors by offering tools for bill management and fraud prevention, ensuring that financial security remains as people get older.

‘End-of-life’ planning: The estate planning industry, traditionally reliant on paper-based processes, is ripe for digital transformation. Platforms like Everplans and Trustworthy are leading the charge, offering secure digital vaults for families to store and manage essential documents. Traditional players too are beginning to enter this space—Fidelity Investments, for example, offers FidSafe, a free tool designed to streamline digital estate planning by allowing users to store and share vital digital files. Beyond document management, some companies are revolutionising the entire process. Platforms like Vanilla and Luminary, leverage AI to handle tasks such as document extraction, estate visualisation, and tailored reporting, bringing a new level of efficiency and personalisation to end-of-life planning.

It’s worth noting that up to 70% of wealth transfers fail (only 30% are successful) primarily due to poor planning and a lack of family involvement. Additionally, 70% of wealthy families lose their wealth by the second generation, and 90% by the third - across various cultures - underscoring the critical need for early and comprehensive estate planning to ensure wealth preservation across generations.

2. Serving the next generation – the beneficiaries

Inevitably, with careful estate planning too comes the transfer of assets to future generations. As wealth shifts from Baby Boomers and Gen X to Millennials and Gen Z, these digital natives bring new expectations for managing their money. Unlike their predecessors, they desire more from their providers, expecting services that are immediate, accessible, and personalised to their needs.

Serving the high-net-worth:

In the US, a small yet influential segment of households controls a significant proportion of the nation’s wealth. This 1.5% - those classified as high-net-worth (HNW) and ultra-high-net-worth (UHNW) - are set to account for a whopping 42% of the total wealth transfer equating to $36 trillion. Yet with multi-generational estate structuring, global tax considerations and management of diverse portfolio these wealthy families face many complexities when it comes to their finances.

Addressing these unique and often intricate needs is a wave of new companies emerging to capitalise on this next generation of affluent individuals.

Wealth aggregation platforms – golden source of truth: HNW clients often have intricate portfolios spread across multiple institutions and asset classes. Getting the full picture of their finances is a complex yet critical task for effective wealth management. Platforms like Masttro, WealthArc and 1FS are leading the charge in account aggregation, providing tools that consolidate financial data from various sources such as banks and investment managers into a single dashboard view.

Hyper-personalisation at scale: HNW clients increasingly require highly personalised investment solutions tailored to their unique goals and objectives. Often, traditional wealth managers are falling short in this domain due to their reliance on standardised models and outdated technology, which limits true customisation. Companies such as Evooq/EdgeLab and Quantifeed are emerging with advanced portfolio construction tools powered by AI and real-time data. These innovations enable wealth managers to create and scale hyper-personalised investment strategies that are finely tuned to meet the needs of their HNW customers.

Front-to-back wealth management systems: Mid-market wealth managers and family offices have traditionally relied on a missmash of legacy platforms to perform their administrative back and middle office tasks such as portfolio management, books of record and risk analysis. Designed for large institutions, this expensive and cumbersome software is a drain to the squeezed margins of mid-market firms. Companies like Performativ are already innovating in the space, offering a fully integrated, front-to-back wealth management operating system. Their platform seeks to consolidate all functionalities (portfolio management, CRM, risk analysis, back office) into a single solution, enabling wealth managers to deliver personalised services to their clients effectively.

All-in-one platform for financial advisers: The tech infrastructure for financial advisers is largely broken, with many relying on up to seven software tools to manage their work (according to Next Wealth). This disjointed and ineffective tech stack leads to significant time wasted on low-value tasks rather than meeting and serving clients. The holy grail for the industry is an all-in-one platform that seamlessly integrates all core capabilities into a single, streamlined solution. Companies such as Savvy Wealth in the US are pioneering this space, offering a comprehensive platform built to address these inefficiencies and enhance time spent adding value for clients.

B2C digital family offices and private banks: Traditionally, tech-enabled companies serving HNW clients have operated in a B2B model. However, a new wave of B2C platforms is changing this landscape. These platforms, such as Arta, Alpian, and Ramify are not only targeting HNW individuals but are also broadening their services, targeting the mass affluent —those with wealth ranging from a few hundred thousand to a few million. These digital platforms offer services akin to a private bank, including access to private markets, financial planning, and tax optimisation all through a digital interface. Leveraging AI to automate tasks, they can significantly reduce their cost to serve opening the door to a host of potential new customers. Their approach is garnering significant traction with younger HNW and emerging affluent clients seeking tech-driven, streamlined solutions.

Serving the Masses:

For the large number of individuals who fall outside the high-net-worth bracket, a significant opportunity remains. Many of those inheriting are left uncertain as to how to manage their newly acquired finances with little to no long-term financial planning in place. To overcome knowledge gaps, many are turning to non-traditional sources, such as social media or online courses, to build financial literacy but with unreliable and untrained sources at mass, there is a gap for digitally enabled sound advice. This presents not only an opportunity to provide and democratise access to financial products to this market, but also to serve as a trusted educator and guide for those unsure on how best to manage their assets. This trend is one we have already seen unfold over the past two decades, and to understand what comes next, it’s important to first take stock of what we’ve seen emerge so far:

From budgeting to investing: It began with personal finance apps like Mint and Acorns, which democratised financial management and micro-investing. These platforms made it easier for users to take control of their finances by providing simple tools for budgeting and saving, laying the foundation for a more engaged and financially aware consumer base.

From micro-investing to robo-advisors: Building on this foundation, robo-advisors like Betterment, Moneybox, Nutmeg, and Wealthfront brought algorithm-driven, diversified portfolio management to the masses. By lowering the barriers to entry, these platforms made investing accessible to those with limited capital, offering a hands-off approach to wealth building through automated, low-cost solutions.

Democratising access to alternative investments: The next wave came with platforms like Yieldstreet, Moonfare, and Masterworks, which opened up alternative investments (such as art, real estate, and private equity) to average investors. These assets, once reserved for the wealthy, became accessible to a broader audience, further diversifying the investment landscape.

Financial planning for all: While financial planning has largely been the domain of wealthier individuals, we are starting to see companies bringing this service to the masses. Platforms like Wealthsimple or Personal Capital/Empower are bridging this gap by offering hybrid advisory services that blend automated investing with access to human advisors, providing a more tailored experience even for those with more modest assets. Additionally, B2B financial planning software like Conquest Planning or eMoney are empowering financial advisors to offer sophisticated planning tools to a broader client base, helping to democratise access to comprehensive financial planning.

What’s next? The future of wealth management is moving towards fully integrated, one-stop-shop platforms that will offer everything from banking, budgeting and investing to tax optimisation and insurance in a single, seamless experience. Companies like Revolut and SoFi are at the forefront of this evolution but we’re still in the early stages. Currently, these comprehensive services are mainly targeted at high-net-worth individuals (given the high costs of customer acquisition and service) but as technology advances these capabilities are expected to be more widely accessible to the masses.

Our market map is intended to be an ever-changing representation of the space. If you think there’s a company we have missed then please let us know. Equally if you’re a founder or investor as excited about this space as we are then we’d love to connect. Please reach out to marine.auge@fisv.com.

Note: The opinions expressed in this article are solely the author’s and do not necessarily reflect the views of Fidelity International.

Thanks for reading, if you enjoyed this edition, please give it a ❤️ at the top of this email.

Upgrade to become a premium subscriber and receive:

Additional exclusive graphs on how the ageing population is impacting society

$1M in discounts at the likes of Hubspot, Notion and other platforms

Complete access to our data room

Full access to all New Economies newsletter editions

The Operators Handbook: All the resources to launch your entrepreneurial career.

See you in your inbox again soon!

Good insight and map !!!

Great read! Interesting insights and explanation of how the mechanics of wealth work and shift.