The Ageing Population

By 2030, for the first time in U.S. history, people over 65 will outnumber those under 18.

By 2030, for the first time in U.S. history, people aged 65 and over will outnumber those under 18.

With people living longer, birth rates declining and couples getting married later, the global population is experiencing a significant shift. The demographic of those aged 65 and over is growing rapidly, and this change is bringing both challenges and opportunities to the global economy.

Hey Readers 👋

Welcome to this week’s edition of New Economies, a newsletter exploring the latest technology trends shaping our world.

Throughout this edition, we explore The Ageing Population and discover how this demographic trend is influencing everything from AI to healthcare and what it means for our future economies. Whether it’s innovative new AgeTech startups or the ways societies are adapting to an older population, we have some fascinating insights to share with you.

Let’s get started!

What is The Ageing Population?

The economy is seeing a significant demographic shift. Never before have so many people been reaching the age of 65 and over, and the implications are going to be challenging for the years ahead.

Today, there are nearly 1 billion people over the age of 60. Now you might be thinking these age demographics are no longer active and moving around, however they are. They are healthy and have money to spend.

This demographic is growing faster than any other age group, and by 2050, 1 in 5 people globally—around 2 billion—will be over 60.

The impact of The Ageing Population

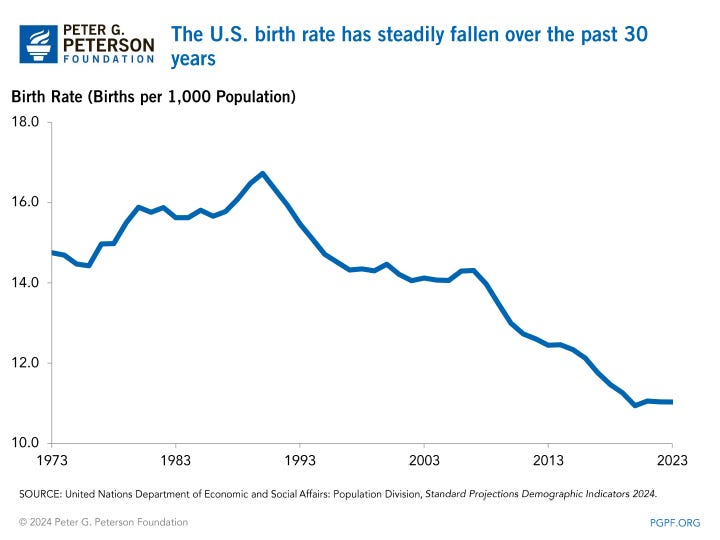

With the ageing population growing rapidly, this will in due course have implications on many local economies. Early data is showing, couples are getting married later and not producing as many children. If we are producing fewer children than those entering retirement, then this will have an impact on economies around the world.

A few examples:

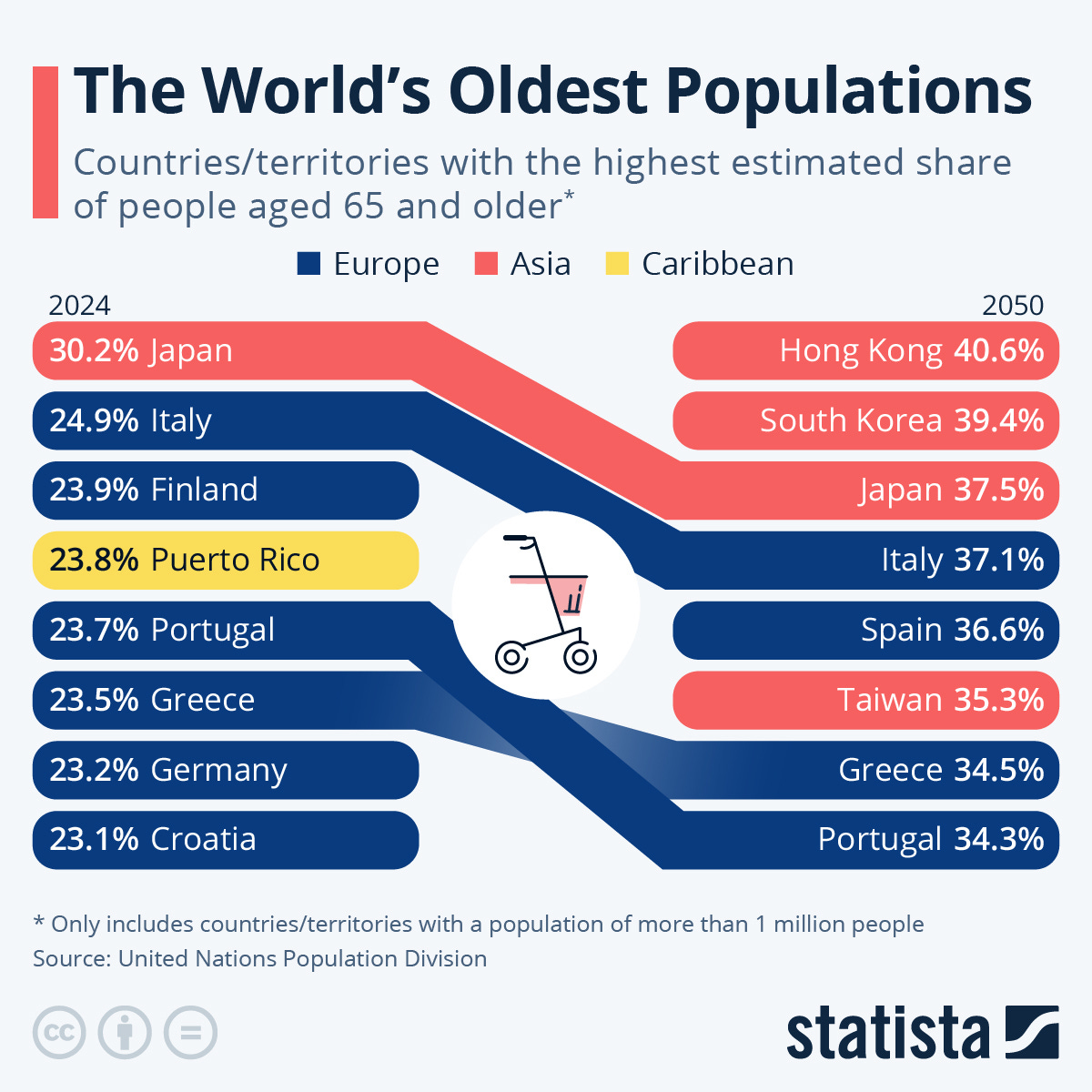

Japan has the highest share of people over the age of 65, followed by Italy and Finland. If data is accurate, by 2050, Hong Kong will have 40% of their population over the age of 65, closely followed by South Korea and Japan.

Japan’s rapid growth in the ageing population

Since 2013, more than 25% of Japan's population has been aged 65 and older, making it the country with the oldest population in the world.

By 2050, many countries with currently low GDPs will experience a significant increase in their working-age labour forces for the first time.

Where are the youngest population living?

The countries with the youngest population include Guatemala and Haiti in the Americas, Niger and Uganda in Africa, Kosovo and Albania in Europe, Palestine and Yemen in the Middle East and Afghanistan & Timor-Leste in Asia-Pacific.

How does this affect the economy?

Regions with low GDPs are expected to work later in life beyond the age of 65.

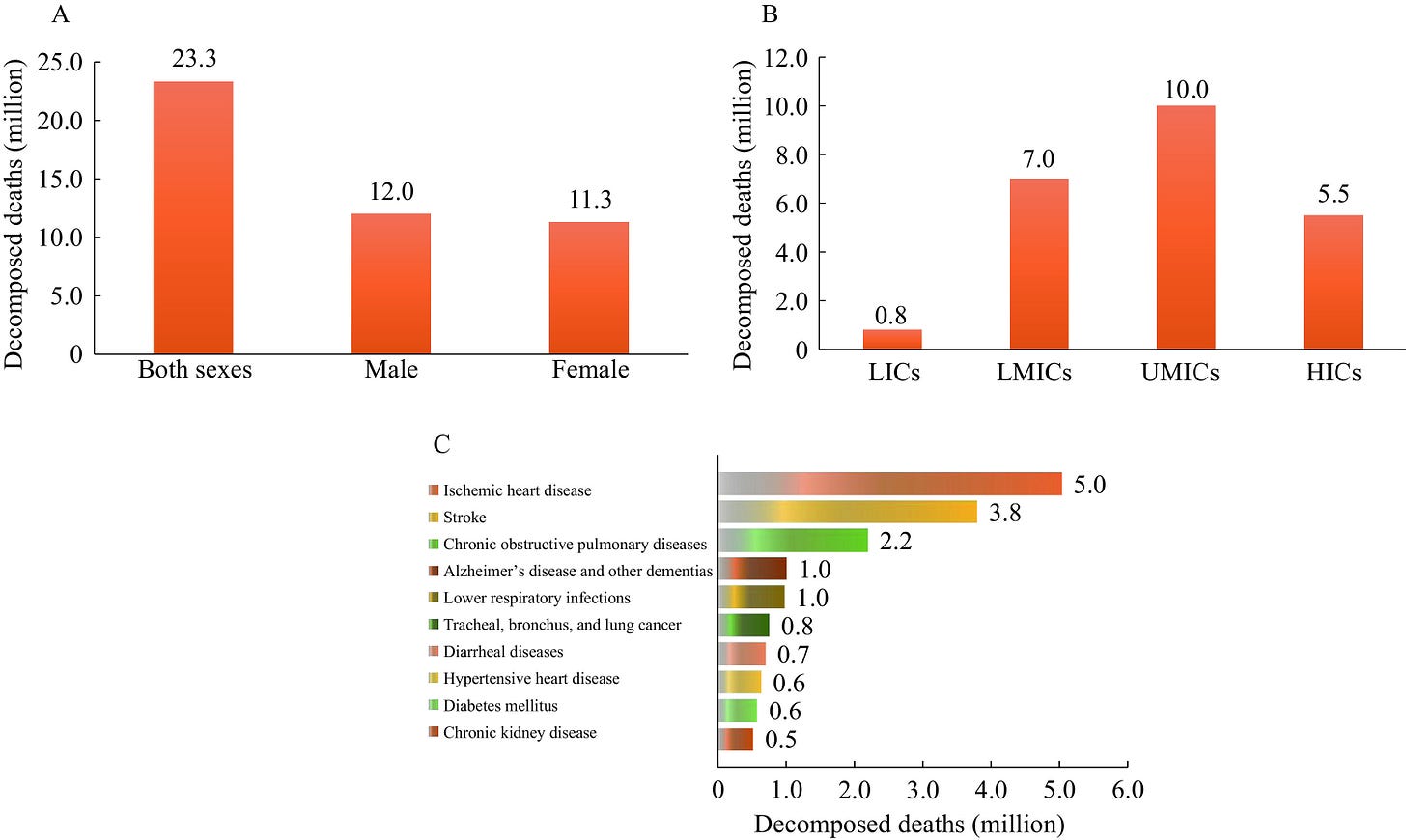

Causes of deaths

Global deaths associated with population ageing between 1990 and 2019. The below graph describes causes of death for this demographic.

Source: National Library of Medicine

How does this affect us?

The ageing population has an impact on the global economy in some of the following ways:

Purchasing Powers: By the time age demographics have reached the age of 65, they most likely have everything they need reducing purchasing powers.

Couples are getting married later: With people getting married later or having no children, couples want to experience more in life before settling down such as travelling, or saving up for future wealth.

Fewer newborns and more people reaching age 65+: A supply shortage of qualified healthcare workers.

Education: Schools and universities may have less students with fewer newborns entering the world.

End of life: For those being buried, will we eventually run out of space in cemeteries?

Introducing The AgeTech Landscape

To help navigate this evolving landscape, we’ve created a market map that highlights the 160+ early stage startups supporting the ageing population and the ecosystem surrounding it.

Descriptions of each category:

Personal Care

For healthcare providers: Devices or software for healthcare providers

In-home & remote care: Marketplaces or platform to find carers for in-home or remote care

Cognitive Health & Dementia: Software and platforms supporting those with the likes of Dementia

Companionship: Platforms for those looking for companionship

Home care technology: Home care technology platforms

Fitness & Wellness: Fitness platforms for those advancing in age

At Home

Fall detection & prevention: Devices to track falls

Everyday help: Platforms and services supporting for everyday help

Staying connected: Local communities

Smart homes: Smart home technologies

Assistive tech: Devices for those who need assistance such as hearing

Wearables: Wearable devices

Finance

Finance & Fraud: Platforms preventing financial fraud

Insurance: Insurance providers for those advancing in age

Financial Planning: Financial planning

Future Planning

End of life: Platforms such as creating a Will

Legacy: Keep all your moments and photos in one place

Other

Supplements: Supplements

Community Management: Software platforms for community management for the elderly

Brain Health: Brain health products

Workflows: Software workflows.

Disclaimers:

Some of these startups may fall into more than one category. They were placed into their featured category based on how they describe themselves on their marketing website.

At the time of publication, each startup appears to be operating.

The AgeTech Investors Landscape

Out of the 300+ investors who have invested in at least one of the startups featured in our market map, the following have appeared the most frequently.

MassChallenge, Alumni Ventures, Bling Capital, Techstars, YC, Google for Startups, Gaingels, General Catalyst & Khosla Ventures.

Access the data in full

Included in the dataset, you will find the following information on the startups featured:

Name of company

Category and sub category the startup is building in

Website

One line description of the company

When the company was founded

Name of founders

Location

Funding: Latest funding stage, last and total funding amount & co-investors.

Opportunities in building startups for the next generation

Although the ageing population is a concern, this opens up a number of potential opportunities for founders who are looking to build and make an impact on the ecosystem. Some of those opportunities may include:

Improving access to affordable care

With private care homes costing $1,000(+) per week, how will the middle-class be able to afford this type of care in the future?

AI in Healthcare

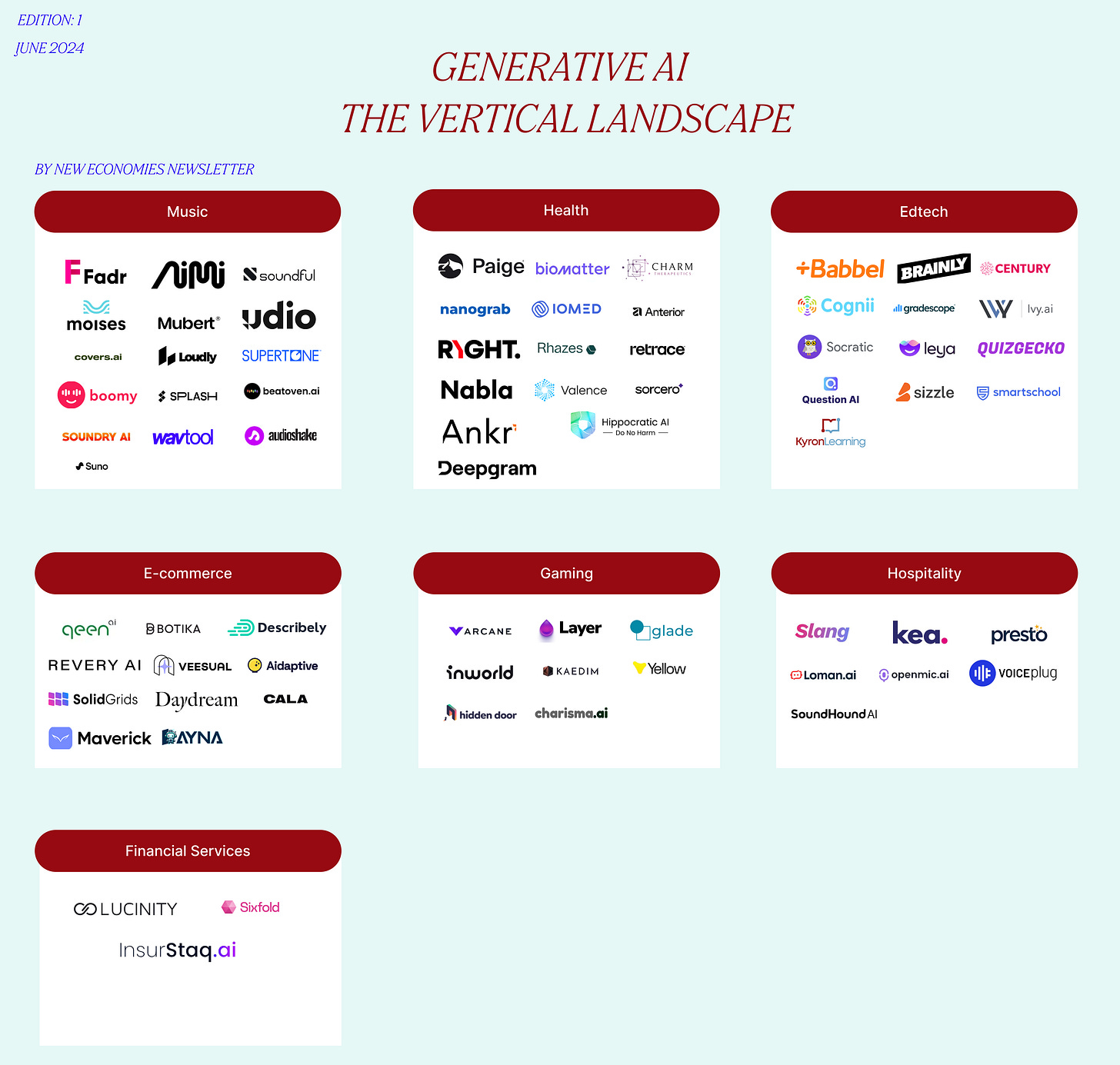

AI will be able to provide in the future, all of us with a form of virtual doctor at almost no cost. I am a big believer that in the future, all of us should be able to access the best healthcare at the fraction of the cost vs what it may cost today.

Co-pilots for the ageing population

With healthcare systems being complex setups, many organisations are always looking to improve efficiency. There are now a number of startups emerging which will fully automate:

Booking appointments for patients

Summarising medical results

Automating & improving medical records

We recently mapped out the latest startups building Generative AI for healthcare a few months ago of which, a number are rapidly improving efficiency for healthcare related organisations. Read the insights in full.

The Loneliness Landscape

With 1 in 4 of us feeling lonely at times, there are hundreds of startups attempting to solve the problem. If you missed our recent piece on The Loneliness Landscape, you can read it here.

Insights

On top of the startups and trends mentioned above, there are also a number of insights, some of which I found interesting. I hope you do also:

Americans over 50 are doing extreme sports their grandparents never imagined

In the past decade, the number of people 60 and older registering for Ironman’s 140.6-mile and 70.3-mile triathlons has quintupled from around 2,500 in 2012 to nearly 13,000 last year.

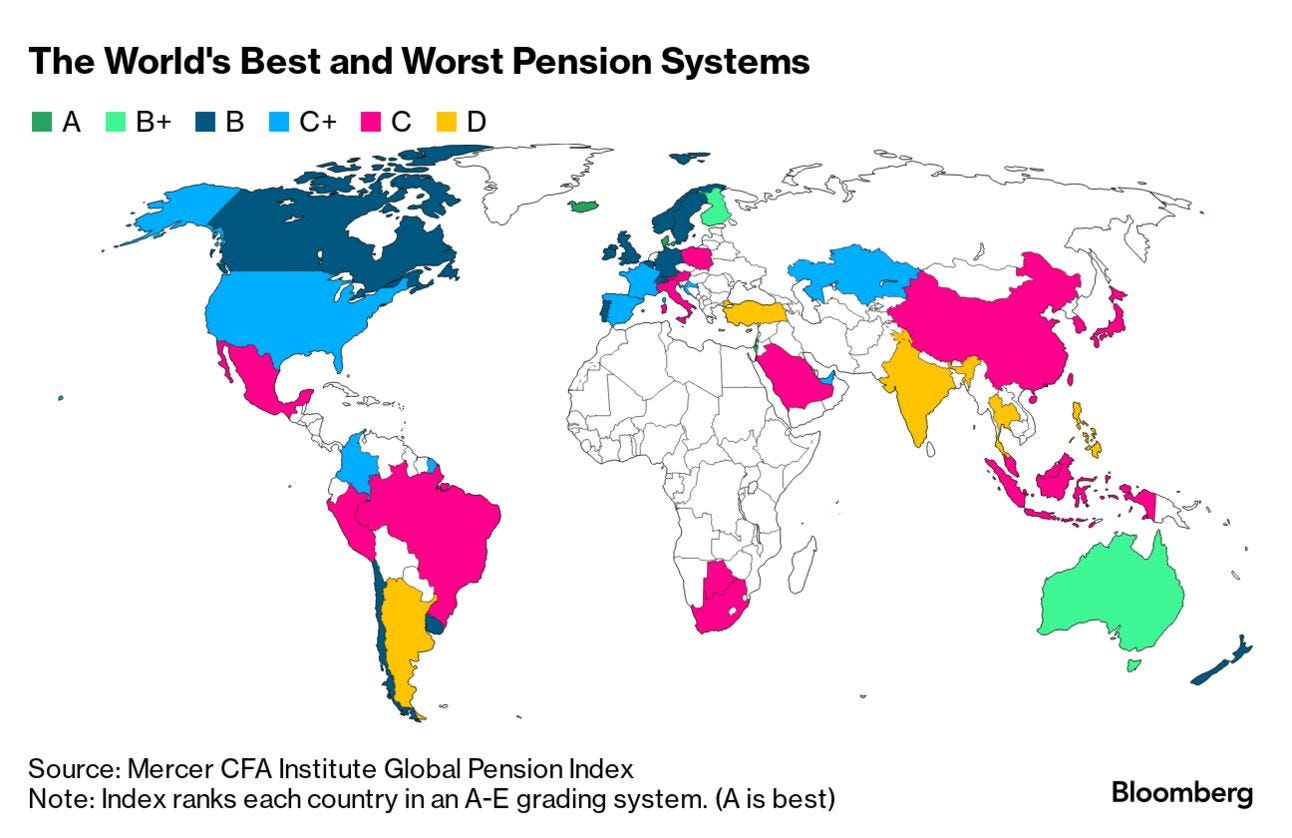

Poor pension systems

Pension systems in most countries, are under stress from ageing populations, rising government debt and high inflation, while also grappling with challenges such as the inclusion of gig economy workers.

Super aged Societies

Some 'superaged' societies will see old-age dependency ratios increase substantially through 2040.

Ecosystems to watch: Case Studies

Thailand (Source: World Health Organisation)

Thailand is among the fastest ageing countries in the world. Of its 67 million population, 12 million Thais, are elderly according to the latest national statistics report. Since 2005, the country has been classified as an ‘aged society’ as people aged 60 years and above accounted for 10% of the population. It is expected that the country’s elderly population will increase to 28% and that Thailand will become a ‘super-aged society’ by the next decade.

Vietnam (Source: Vietnam Plus)

Statistics show that in 2023, Vietnam had a population of around 100.3 million, including more than 16 million elderly people. The Ministry of Health forecasts that Vietnam will go into the “aged population” period by 2038, transitioning from an “ageing” to an “aged” society, with over 21 million elderly people – equivalent to nearly 20% of the total population. It is noteworthy that the transition from an ageing population to an aged population in the country will happen in just over 20 years, while it takes much more time, even almost a century, in developed countries.

South Korea (Source: The Lancet)

South Korea has one of the fastest ageing populations and the lowest birth rate in the world. The country is on route to becoming a so-called super-aged society by 2025, whereby the proportion of people aged 65 years and over will reach 20% of the total population.

It's clear that the ageing population is reshaping economies, industries, and societies in profound ways. While challenges like healthcare access, labour shortages, and shifting spending habits loom large, opportunities for innovation are equally abundant. From AgeTech startups to AI-driven healthcare opportunities, the future holds exciting potential for those ready to build and adapt. As we navigate these changes, it's crucial to stay ahead of the curve and embrace the new economies being shaped by this demographic shift.

Thanks for reading, if you enjoyed this edition, please give it a ❤️ at the top of this email.

Upgrade to become a premium subscriber and receive:

160+ startups building across the AgeTech category

Additional exclusive graphs on how the ageing population is impacting society

$1M in discounts at the likes of Hubspot, Notion and other platforms

Complete access to our data room

Full access to all New Economies newsletter editions

The Operators Handbook: All the resources to launch your entrepreneurial career.

See you in your inbox again soon!