The 2023 Creator Economy: A new direction

As uncertainty and macroeconomic challenges pervade, learn how are creators pivoting and where creator economy is heading.

Two years ago, when we published the first ultimate guide on the creator economy, the category was booming at an unprecedented speed. In 2021, we saw a rise in platforms allowing creators to monetize, partly driven by COVID-19 and prompting thousands to turn to these platforms to make an income. To benchmark the 2021 success of creator economy companies, a record 11 companies reached unicorn status throughout the year.

In 2022, the creator economy shifted in a different direction. A number of platforms pivoted or launched services that enabled creators to issue NFTs, tokens, or crypto-related assets, which we mapped in our 2022 report.

Now here we are in 2023, and the sector is experiencing a dichotomy. On one hand, today is the most exciting time for the creator ecosystem, but it is also the year that could prove the most challenging given the macroeconomic environment. For the first time since its inception, the creator economy is facing a difficult phase. Brands are reducing their marketing budgets, creator platforms are making a number of layoffs and shutting down, venture capital is becoming more cautious about investing in this area, and the number of platforms achieving unicorn status has plateaued.

Are rumors of the creator economy’s decline greatly exaggerated? We think so. Despite the headwinds, the number of people becoming creators is increasing—motivated by their quest for independence, flexibility, creative freedom, and uncapped earning potential. We believe the new creator economy will weather this storm in the coming year through two priorities: community building enabling creators to build closer relationships with their fans and creators diversifying their income streams.

Welcome to our 2023 creator economy report, where we are excited to share an in-depth analysis of the current state of the creator economy, key trends for the year—including the impact of community and Generative AI—and our view on where the sector is heading.

Curious about who is shaping the future of the creator economy? Don’t miss our list of 50 creators to watch this year.

In this report we also share:

The latest 190+ startup platforms to watch, categorized into four buckets: Web3, Generative AI, Creator Growth, and Operations.

A showcase of the latest trends and concerns for the next 12 months highlighted by 30+ creators around the world.

Let’s dive in.

"The creator economy continues to grow exponentially, and over the past 12 months creators have been identifying and understanding the playbook for building sustainable businesses. In 2023, creators will continue to diversify their businesses and revenue streams and we will see more technologies like AI emerge as a critical resource for creators to improve their creativity and streamline workflows. Community will play a significant role with creators in 2023. This is something we are deeply focused on here at Spotter as it allows creators to fail fast and learn together." —Aaron DeBevoise, founder and CEO of Spotter

The current landscape

What happened in the past year?

The creator economy has received growing attention in recent years, particularly since the COVID-19 pandemic. This is due to several factors—the number of people becoming creators has significantly increased, alternative ways for being discovered have opened up, new income opportunities have come to fruition, faster ways to gain viral fame have become much easier thanks to platform algorithms, new platforms have been emerging, and more.

However, the future of the creator economy is uncertain, as platforms struggle to secure large investments and many of the long-tail creators fail to earn significant incomes. Despite these challenges, many people are still optimistic about becoming creators in the future. But we see the industry moving toward consolidation rather than rapid growth—for now.

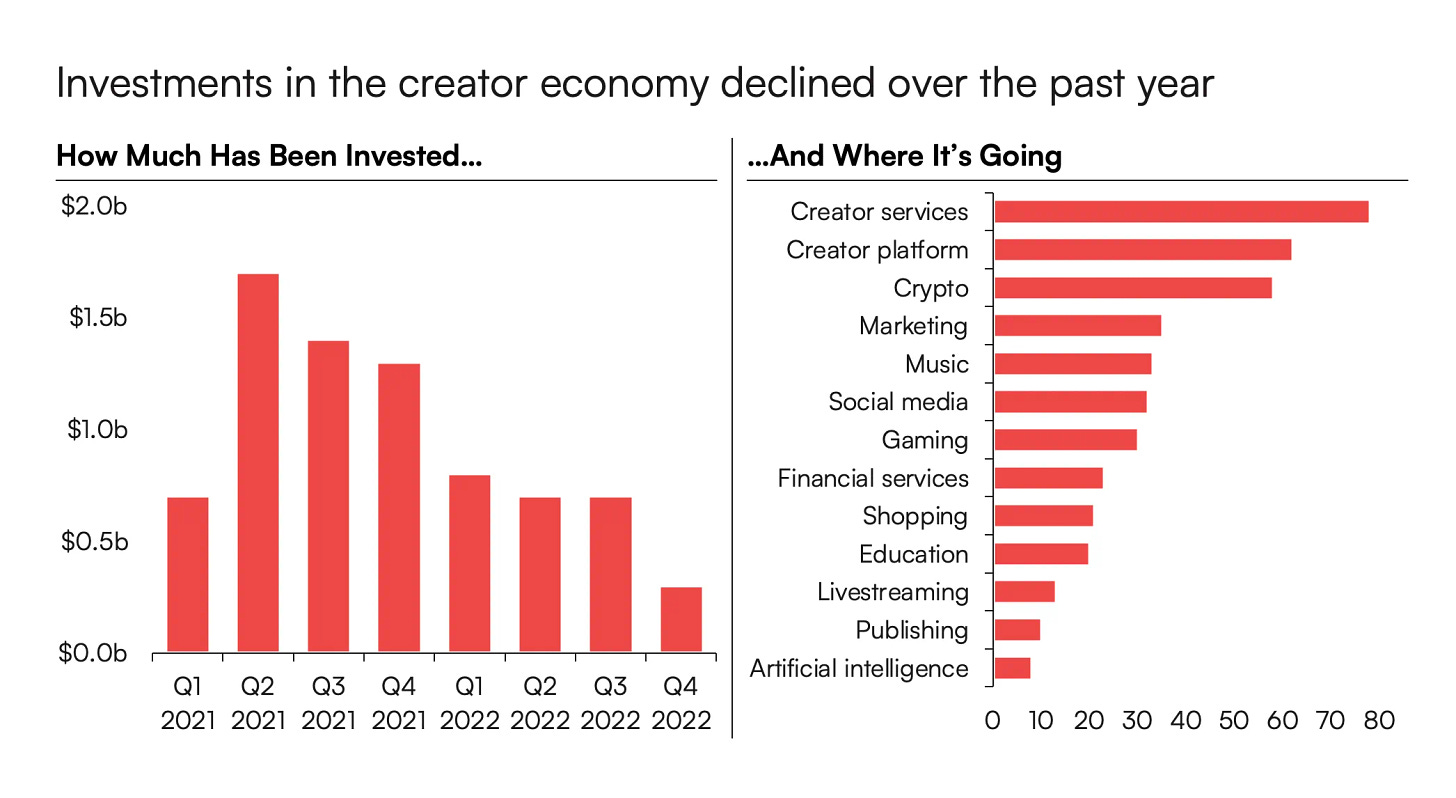

Investment in creator economy startups has also dropped, with only $180 million invested in Q4 2022 in the US, compared to the ~$500 million invested in the space in each quarter since Q1 2021. This decline could be due to factors including the threat of a recession, widespread layoffs, and startups raising at tempered valuations. Despite these challenges, creators are still likely to play a significant role in shaping future economies and may even go on to create successful and well-known brands. It is possible that some creators will become unicorn founders—it’s just a matter of time.

"I think many of the creator platforms launched in the past few years with sky-high valuations may come to learn that the addressable market is much smaller than they originally believed. There are only so many full-time ’professional’ creators who drive meaningful economic value for these platforms. They will have to be very clear on who their core customer is, how best to serve them, and ultimately how big the opportunity is as there is increasingly a distinction between the passion economy and the creator economy." —Megan Lightcap, investor at Slow Ventures

What’s in store for the creator economy this year?

The creator economy market size is still $100 billion. It is not failing—it is evolving and changing direction. As the threat of recession looms, affecting both creators and platforms, there will be limited platforms in each category that support creators. Creators are likely to see a reduction in income, particularly those who depend on brand partnerships. Burnout is a persistent problem for many creators, but many are becoming more aware of the economic conditions and are working to diversify their income sources and audience base. As a result, we can expect to see platforms make more transparent and binding commitments to creators.

On the platform side, the space saw a substantial decrease in funding in Q4 2022. For the creator economy to be a key category of interest, this year we must see: a rise in funding for platforms, which will be tough given the current fundraising environment; platforms being more flexible on how they cater to creator needs such as upfront payments; more transparency around how platforms charge creators; and the option for creators to own and have direct access to their fans.

Here are some of our 2023 predictions for the sector.

We expect creator platforms to:

Pivot or close shop if they have yet to find product-market fit and have been operating for one-to-two years. As Matt Cooper, CEO of Skillshare, highlights: "2022 was a tough year for creator economy businesses and we expect that to continue in 2023. There are many startups that will fold, and many larger platforms that will need to restructure how they pay their creators and how they make money themselves. At the same time, we will continue to see creators diversify their income streams as well."

Transition to allowing creators to own their audiences and diversify their income streams such as integrating live commerce.

Be much more committed to creators than ever before.

Become more transparent about how they charge creators and how their algorithms work. This is a huge point of frustration for the creators we interviewed for this report.

Enable creator collaborations.

Consolidate—creators can only use so many platforms to generate revenue and ones to run their operations.

At the same time, we anticipate creators will:

Launch their own branded product lines. This builds onto an existing category in the creator economy but it can go so much further, extending to platforms that support with distribution, commerce analytics, payments, supply chain management, and more.

Be global from day one with the help of Generative AI. Platforms are now emerging enabling creators to turn their content (text, video, or voice) into any language and while still being in the creator’s voice.

"While the top echelon of creators has achieved enormous success, the middle class of creators has been slow to emerge, leaving many creator startups stuck between a rock and a hard place. If companies focus on acquiring only the long tail of creators, they fail to achieve meaningful scale even after gaining thousands of users. After all, collecting a take rate on the earnings of creators making pennies ultimately cannot amount to a sizable business. On the flip side, if startups target only the top tier of creators, they limit their market opportunity and face daunting customer concentration, such that one churned customer could cost them a third or more of their business. Striking a balance by targeting the growing mid-tier of creators plays a crucial factor in building a sustainable business." —Alexa Tsay, investor at Left Lane Capital

A new direction for the creator economy: Community

A next phase for the creator economy will have a particular focus on community, which can play a significant role in the success of creators. A strong community can provide support, encouragement, and a sense of belonging to creators, helping them produce and share their content more consistently and confidently. In addition, a supportive community can also help to promote a creator's work and bring in new viewers or followers. This can be especially important for creators who are just starting out and trying to build their audience.

"I am most excited about the trend of creators finally owning their community. The days of building empires on rented land are over." —Nas Daily, Creator

The 2023 creator economy landscape

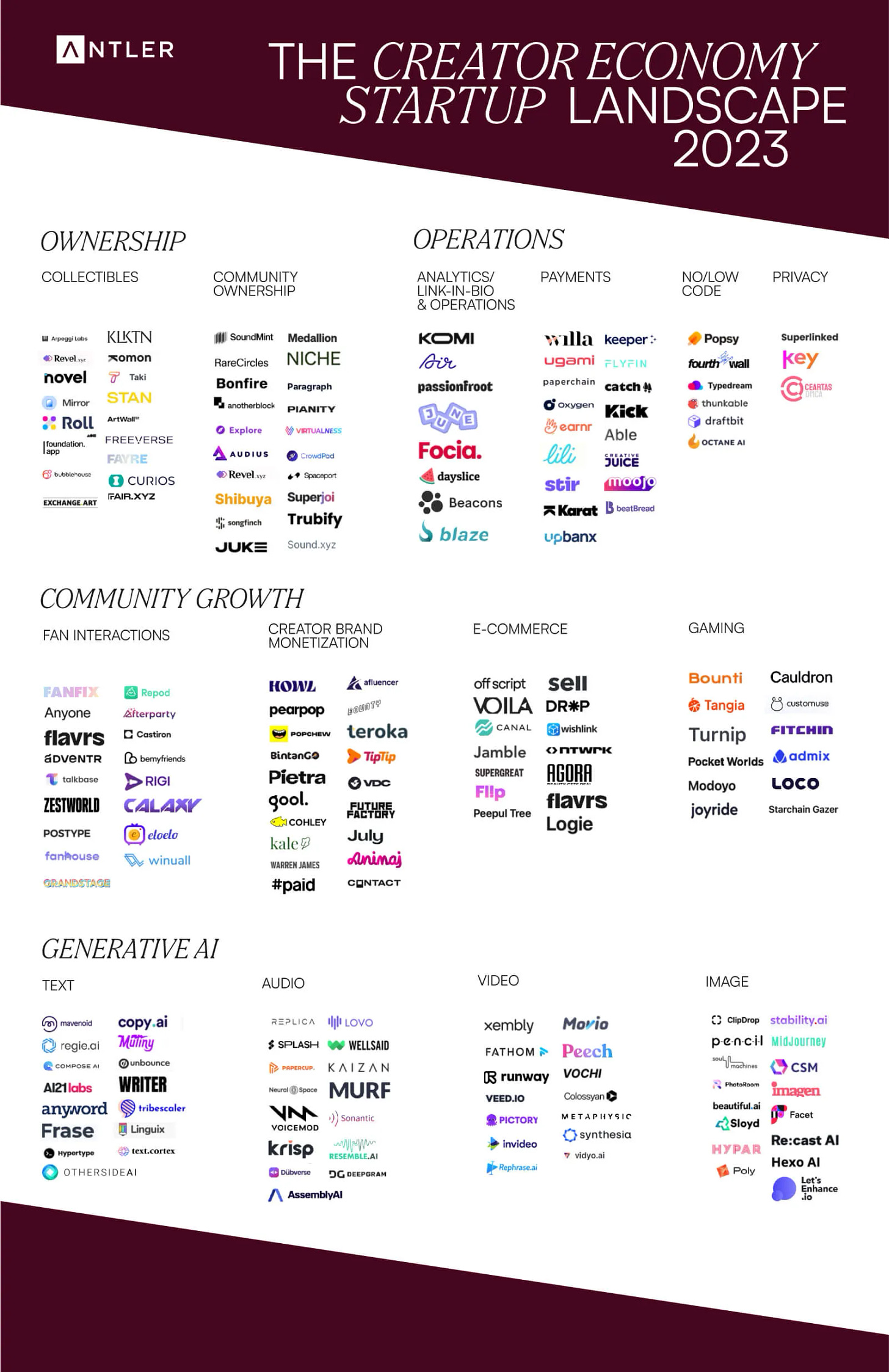

What are the four key categories in the creator economy landscape that we think will attract the most attention in the coming year? Ownership, Community Growth, Generative AI, and Operations.

Ownership. Includes platforms that allow creators to issue digital collectibles enabling them to own their audiences (community ownership).

Community growth. Categories that allow creators to diversify their income streams from fan interactions, brand monetization opportunities, and e-commerce options.

Generative AI. These technologies will have a substantial impact on creators. We included the categories that creators will most likely use as a starting point (text, audio, video, and image).

Operations. Allows creators to see what’s happening in their businesses and grow them at the same time.

Meet the rising startup stars of the 2023 creator economy landscape that are shining in these four categories.

Disclaimer: This market map primarily features startups not widely recognized that have raised capital, which we found through primary and secondary research. You will notice many of the well-respected creator platforms—such as Gumtree, OnlyFans, Patreon, and Substack—are not featured. We chose to highlight platforms that have yet to become household names, which we hope this report assists with. All companies can be found in the dataset below the industry map image. If you are building in the creator economy space and wish to be featured in this and future market maps, complete this submission form for review. Successful submissions will only be featured in the Airtable dataset below. The data of the companies featured in the Airtable was crowdsourced from Crunchbase.

The current fundraising landscape

There was a time when the creator economy was the hottest category in town; however, over the months, the number of platforms has reduced. As highlighted in The Information’s creator economy database, “Total funding for US startups dropped 50% to $2.5 billion last year from 2021. In the fourth quarter, funding fell 79% from the year-earlier period, to $274 million, and marked the sixth sequential drop in quarterly funding.”

Other statistics from The Information show the conspicuous drop in fundraising activity:

In the fourth quarter, US creator economy startups raised $274 million, 79% less than the same period the previous year.

Seven of 23 rounds in the fourth quarter were extensions of previous rounds, or were not named.

Big rounds were rare last year. Only eight US-based startups raised $100 million or more in funding, down from 18 in 2021.

During the pandemic, the creator economy was booming—it was the first time the sector had global attention; however, this came at a cost. Platforms raised at much higher valuations during the pandemic versus those who raised pre-pandemic as the long tail of creators tried different platforms to see which fit their needs. Naturally, as sectors and platforms materialize, there becomes a focus on the well-funded or notable players while others look for survival or the optimal moment to pivot.

While the fundraising stats reported by The Information are not a huge surprise, we have conviction that the creator economy is not dead. It is going through a cycle of materialization and continuous innovation.

"Funding for creator economy startups has declined every quarter since early 2021, and I expect the fundraising environment to remain tricky at least through first half of 2023." —Faraz Fatemi, Investor at Lightspeed Ventures

Who’s investing?

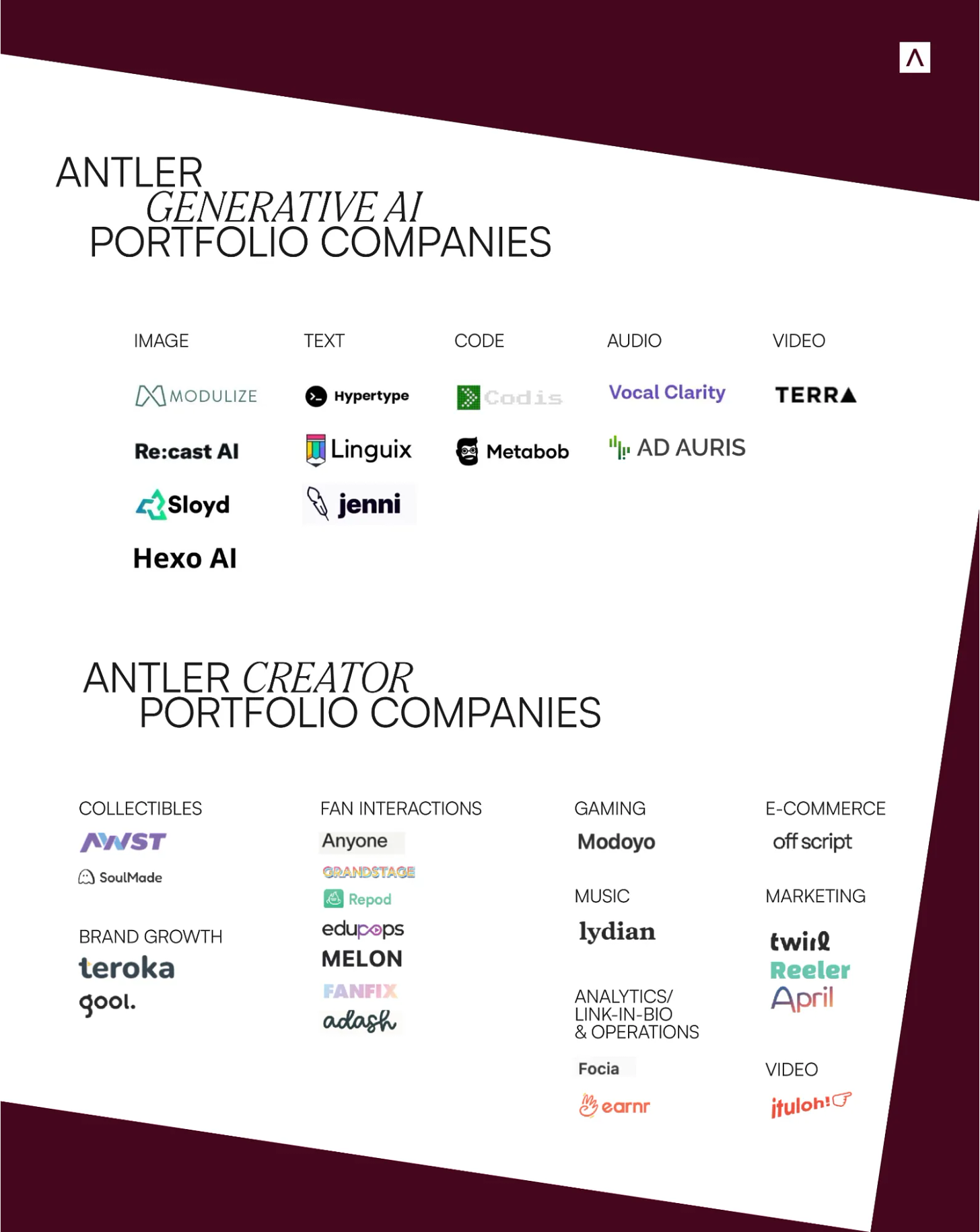

Antler is proud to be the most active day zero investor backing companies in the sector. Thus far, we have made 14+ investments in the creator economy space. Going forward, we are particularly excited about Generative AI, gaming, and platforms that allow creators to own their own audiences.

Creator unicorn-land

What does this all mean for creators?

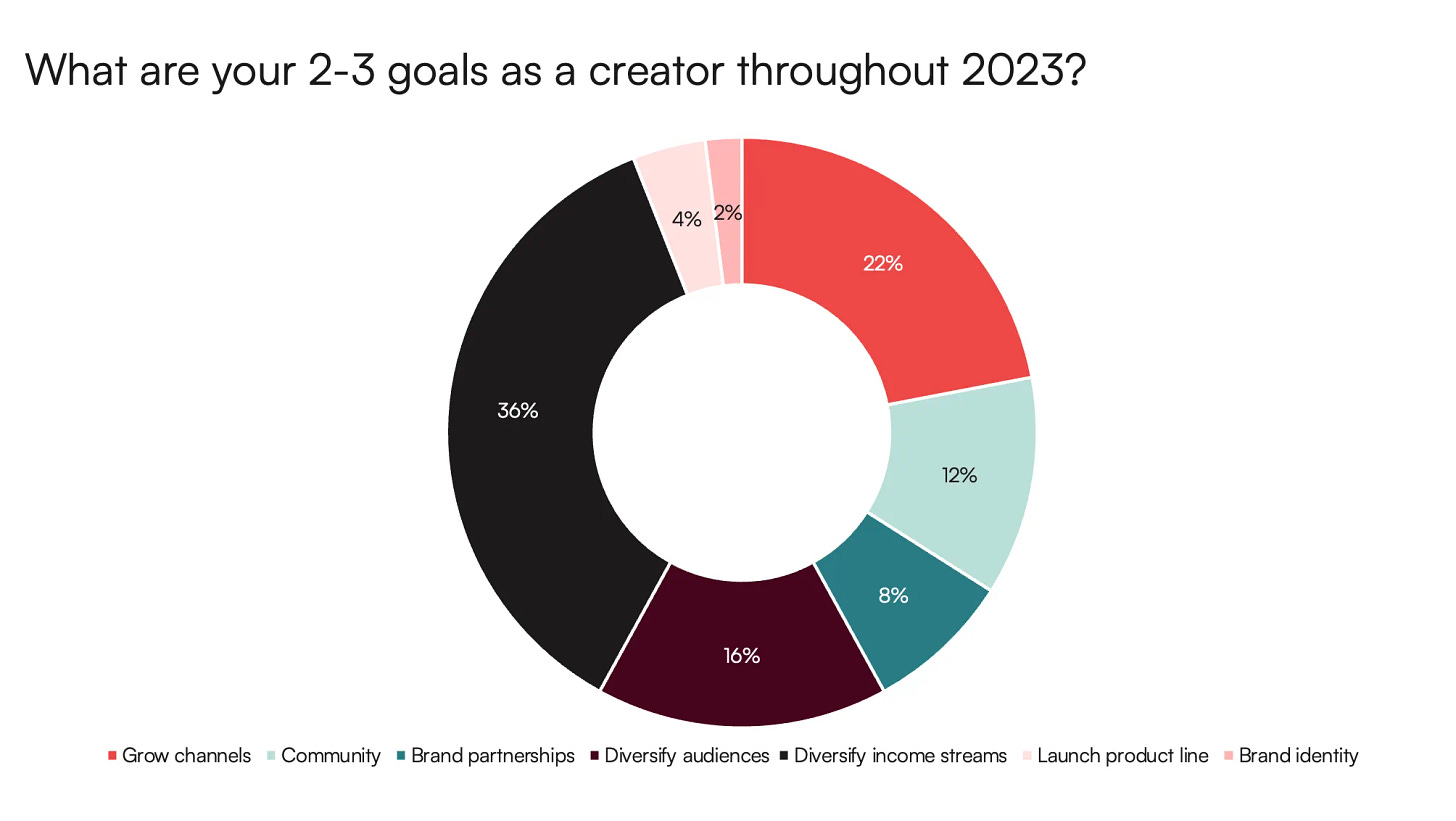

We recently surveyed 30+ content creators around the world to gather their perspectives on trends, concerns, and goals for the coming year. We also asked if they are currently using Generative AI platforms, which we explored in our recent report on this exploding sector.

These creators have 200K+ subscribers or followers, and are renowned YouTubers, TikTokers, or Instagram superusers such as bloggers. The goal of this small survey is to paint an indicative picture of how the creator economy will shape up this year—from the viewpoint of creators.

"The trend I am most excited about is the future of content creation. Living in the age of fast information, the art of creativity is but a finger tap away, leveling the playing field and giving rise to a new era of creators, of any age group, color, size, or preference, whether you're the cool kid or the geek, brilliant or a fool, rich or poor, destined for greatness or haven't a bloody clue, the algorithm doesn't care! Anyone can make it, and that's really exciting." —Toba Courage, creator

Our survey respondents emphasized the following key priorities for this year:

Exploring new ways to diversify their revenue sources. Given the downturn, creators are shifting away from relying heavily on brand deals as companies cut back on their marketing spend.

Diversifying audiences. As creators diversify their income streams, they are also aiming to diversify their audience base. Many creators we spoke with are prioritizing having most of their audience on one platform, and also expressed interest in testing new platforms to expand their reach and build new audiences.

Community building with fans. These creators are focused on building stronger, more personal relationships with their fans, which is a key outcome of owning their own audience data, as discussed in our 2022 Creator Economy report. They want the ability to connect directly with their audience, whether by owning their data or through platforms offering enhanced features that allow for virtual engagement and closer relationships with fans.

"Advertising and sponsorship spend is decreasing, so creators are increasingly looking elsewhere for monetization. That said, the consumer-side economy is still strong and I'm hopeful that creators will use this as an opportunity to diversify into other revenue streams—whether that's branded products, online courses such as cohort-based courses, or starting businesses." —Gagan Biyani, co-founder of Maven

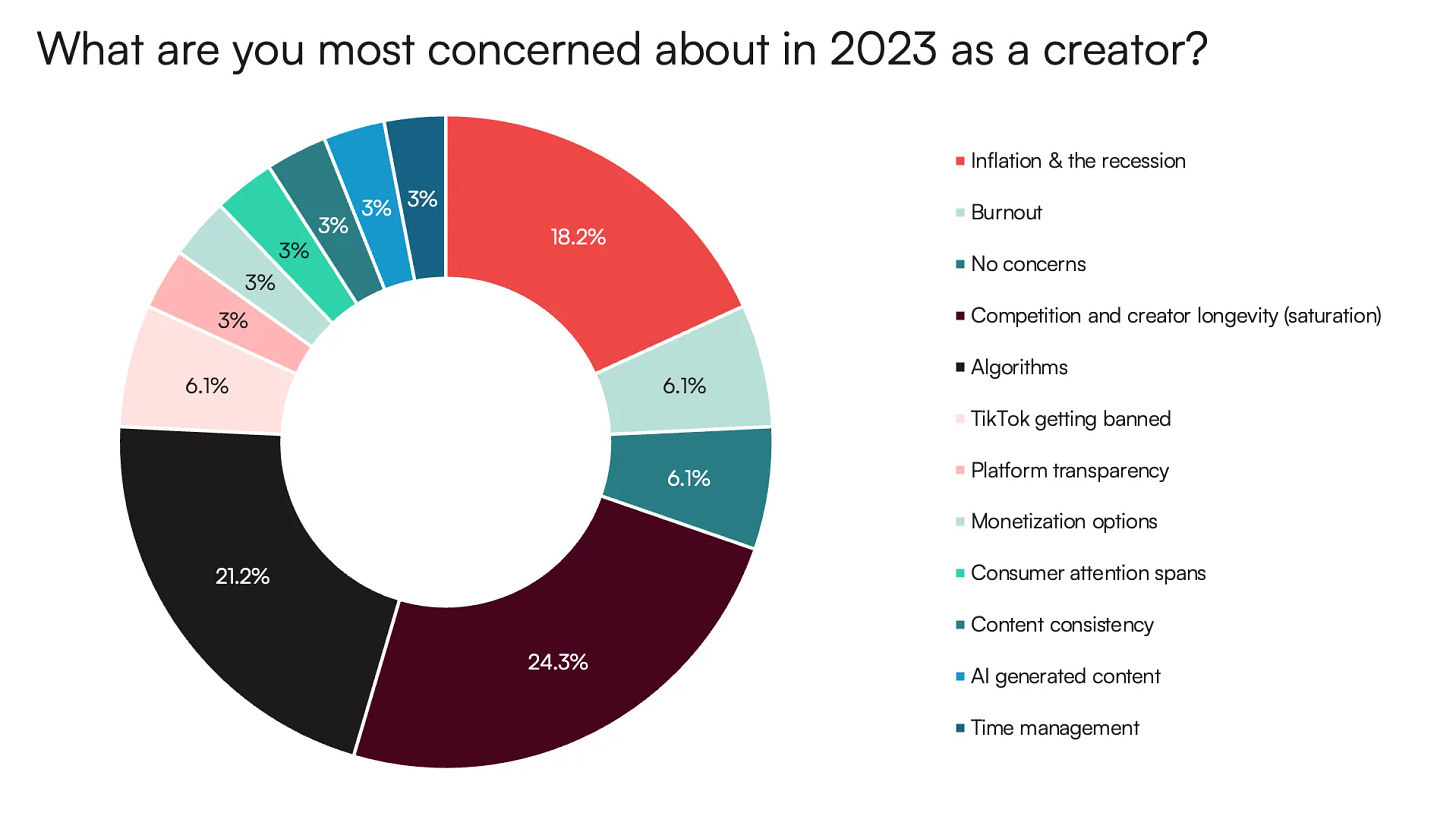

Respondents’ most pressing concerns

"Over the next 12 months, I am most concerned about the potential incoming recession because it will affect the ability to monetize content and build the team in the way I want to. This will affect the entire creator industry as marketing budgets will likely be the first thing to be cut." —Zac Alsop, creator

Algorithms. Interestingly, our respondents did not cite inflation as their primary concern. They are more worried about the algorithms used by platforms that determine how creators reach their audience and make a living. The most frequently mentioned platform of concern among our respondents was TikTok, with some expressing fear of its potential ban.

Inflation. With cut backs on market spends, creators are concerned how inflation may affect their income streams. As a result, one of their main priorities is to diversify their income streams. "Inflation means cut backs on brand deals," said YouTuber Ben Morris.

Increased competition. As the creator economy grows, it's likely that we'll see increased competition among creators as they strive to stand out and monetize their content. This could lead to a greater emphasis on innovation and differentiation in the creator economy.

Emergence of new platforms and business models. Forms of growth within the creator economy is possible in 2023, as creators and businesses look for new ways to engage with and monetize their audiences.

"It's time to wring the excess out of the creator economy and start building for the future. The big media companies of the next 25 years will be built by creators, not traditional companies, and some of those creators are still drinking juice boxes at lunch. It's a long play, but it will deliver outstanding returns for patient investors. Don't let this year's spate of acquisitions and wind-downs taint your long-term view. Like much of tech, the creator economy got a bit ahead of itself. But it's more akin to blowing the head off a fresh pint than staring forlornly at the bottom of an empty glass." —Jim Louderback, creator

"There is still very little transparency—creators don't know how much they could be making, what platforms they should be using, how they should be defining their brand (platforms like Clara that give creators more community help to address this). In addition, brand budgets have pulled back across the board, lowering the viability of a key creator monetization lever." —Faraz Fatemi, investor at Lightspeed Ventures.

What trends will define the creator economy in 2023?

In addition to surveying 30+ influential creators, we asked the most forward-thinking leaders in the sector what they are most excited about for the next 12 months.

The return of part-time creators. “The creator economy landscape has changed drastically since 2020 when I started creating content. In past years the focus has been heavily TikTok, hyper growth focus, and quitting their 9-5 to be full time creators. This year, we will see full-time creators going back to 9-5. There will still be tons of creators but more creators will treat content creations as part-time or hobby.” —Sandy Lin, creator and founder of Creobase

Content that inspires and engages. "While the creator economy continues to evolve and advance in many ways, time is still finite, and people are increasingly becoming more mindful of how they spend their time online. People want to be inspired and engaged by the content they discover with a feeling of their time being well spent." —Ayumi Nakajima, Head of Content & Creators at Pinterest, SEA

Platforms finding ways to keep creators sticky. “Creator platforms are facing two pressures: 1. Inherent virality in social media—engagement platforms flux in popularity constantly and are always battling with the question of how to remain relevant (think VSCO!); 2. Creators seeking more and more ways to diversify their revenue streams, especially in a contracting spending environment. With these pressures, creator platforms need to find ways to keep their creators sticky—primarily through incentive models, which we’ve seen almost every large player struggle with throughout the past year. This risk of churn will become an even larger challenge in the next 12 months, and in response I expect to see: 1. An increased focus on efforts that generate revenue for creators through community and engagement, with a de-prioritization of direct fund models; 2. More collaborations and partnerships between creator platforms; and 3. Consolidation and M&A opportunities in the space.’’ —Saaya Nath, investor at Jump Capital

Creators building billion dollar companies. "Creators are becoming media powerhouses, which is giving them more opportunities to build businesses. Over the next decade, we'll see more and more multi-million and billion dollar businesses started by creators who first built an audience, then decided to creatively leverage their brand to build companies. It has already been a big part of the creator economy, and it will be even bigger in the future." —Gagan Biyani, co-founder of Maven

The emergence of the adult professional creator. “Today, the mental image of a creator is a young creative type in an entertainment-adjacent category like comedy, dance, gaming, food, fashion, etc. This year, we believe we are going to see many more adult professionals making content that isn't entertaining but is valuable. From brand marketing experts to SaaS sales gurus to career coaches and every more niche professional category in between, adult professional creators will continue to emerge to change the face, the economics, and the opportunities of the creator economy in 2023.” —Avi Gandhi, creator

Servicing creators with sustainable revenue streams. “Creators show no signs of slowing down as their businesses continue to evolve into massive enterprises. For platforms and startups looking to thrive in 2023, the focus should move away from short-term creator funds and instead be on how to best service creator economy entrepreneurs with long-term, sustainable revenue streams. We will see more platforms offering monetization outside of brand deals in order to stay competitive—the ones poised for success will be the ones who provide the most value to the creators.” —Aaron DeBevoise, founder and CEO of Spotter

Creator production innovation. "I am most excited about creators launching operating businesses that innovate within the category they operate in. If the first era of creator brands was defined by creators pairing their brand with an existing product (usually within CPG), I think we are going to see a lot more product innovation—especially for creators with deep expertise and authority within a vertical or niche." —Megan Lightcap, investor at Slow Ventures

Here at Antler, we are excited to see the impact of the following trends on the overall creator economy:

Short-form video content: Did you know the average consumer spends 95 minutes browsing short-form video content daily? TikTok has been the number one player in this space and we’ve seen copycats follow suit, including Meta, Instagram, and YouTube. Short-form video content platforms will most likely add e-commerce and shopping opportunities as an avenue for creators to earn additional incomes. For example, YouTube Shorts now has 1.5 billion monthly active users contributing to 30 billion daily views. The opportunity is huge. How these platforms monetize outside of advertising and e-commerce is yet to be seen; however, those are two huge revenue opportunities for platforms to be paying attention to. The creators we surveyed for this report are most excited about the short-form video content opportunity for the following reasons:

It’s much easier to create and scalable at the same time.

Vertical videos are more engaging.

Creators can be discovered much more quickly.

Short-form video is the gateway to long form.

At the same time, creator Sandy Lin warns of the downsides of short-form content that creators need to be mindful of: “Today creators are realizing TikTok and short-form content is not the best way to create an engaging community, monetization isn’t consistent, and constantly creating short-form content is leading to more creator burnout than ever. Creators are reverting back to YouTube to create more engaging audiences. We are heading toward TikTok generation creators treating YouTube as their main platform.”

The hometown creators. Traditionally, it has been the mega stars—the influencers with millions of followers—who deliver a strong return on marketing campaigns and brand deals. This has now changed. Nano-influencers or the “hometown heroes” are the ones who will outperform marketing campaigns. They have a closer relationship with their followers, they know who they are and what they want, and typically have niche audiences allowing the creators to be a leader in the categories they are promoting.

Generative AI. These technologies—which we wrote about in our Gen-AI Report, the first and most comprehensive Gen-AI market map available to all—provide a clear opportunity for creators. Gen-AI offers alternative ways to become more productive and potentially more creative. The tools also allow creators to be global from day one. They no longer need to create content solely in their spoken language, limiting their audience reach. They can now use platforms that will translate their content through voice or text, into any language, using the creator’s voice. The latter does not exist fully yet—however, platforms are emerging that do support creators turning videos into any language using robotic voices.

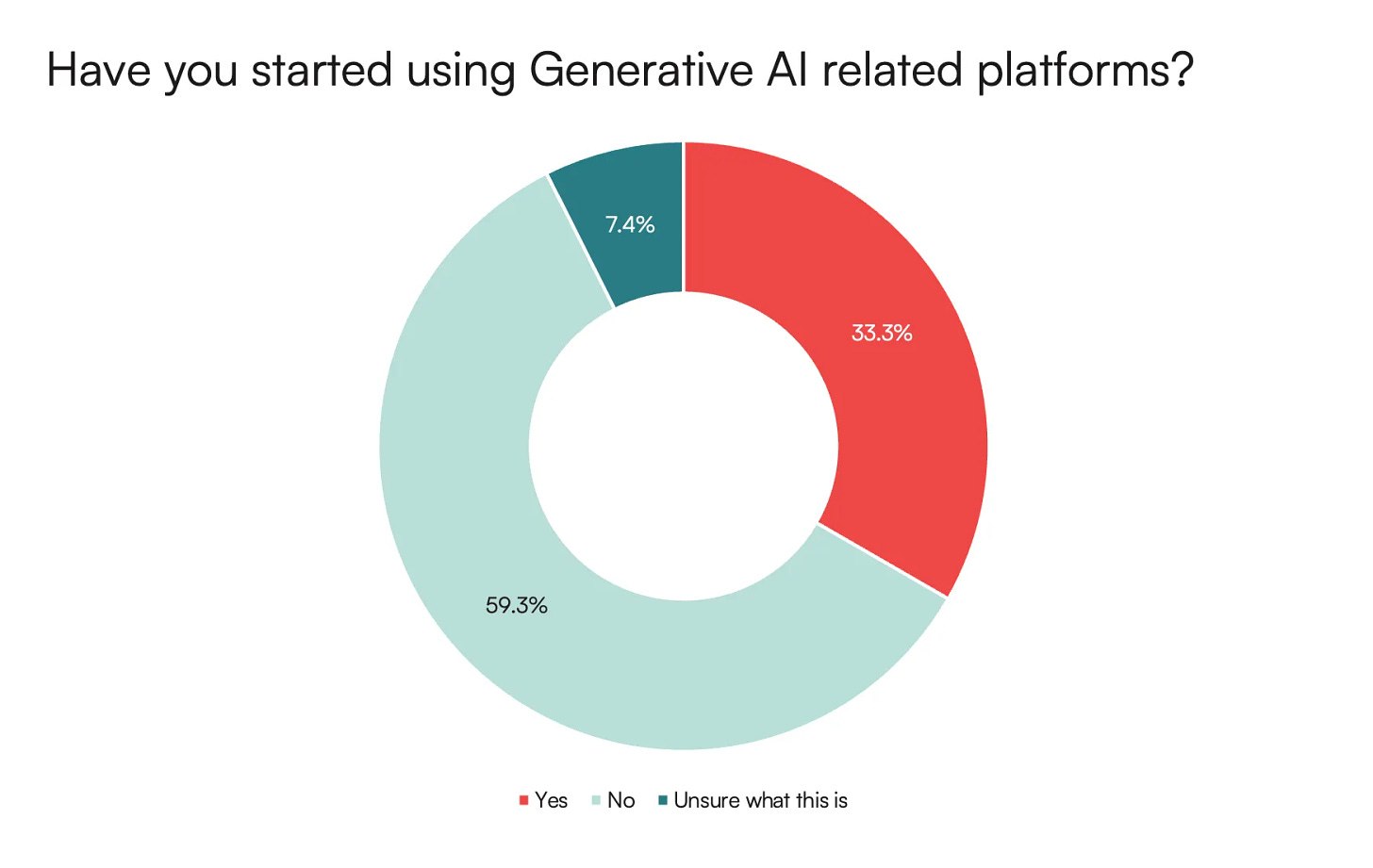

While only 33% of the 30+ creators we surveyed for this report confirmed they have started using a Gen-AI product—and some said they were still unsure what it is—we expect use to skyrocket this year.

Platforms rewarding creators. In 2022, YouTube made headlines by announcing that it would allow creators of Shorts, its short-form video feature, to earn ad revenue through the YouTube Partner Program. Beginning in early 2023, creators will be able to apply to the program if they have at least 1,000 subscribers and their Shorts have received at least 10 million views within a 90-day period. Once accepted into the Partner Program, these creators will receive a 45% share of ad revenue generated by their videos. Although this is a positive development, there are only so many creators who are receiving 10 million views within a 90-day period.

"More people than ever before want to become a content creator. It’s been exciting to see multi-hyphenated creatives—from chefs to fitness instructors to interior designers—build communities and share their unique knowledge and skills to their fans across multiple platforms. A great example of this was displayed by the changes to NIL regulation, which led to an explosion in young athlete-creators in colleges and universities across the US and have now been able to grow robust audiences and create incredible businesses." —Jim Shepherd, Global Director of Talent Partnerships at Snapchat.

"I'm super intrigued by the capabilities now to rapidly localize content in several languages which allows for truly global consumption and the ability to create culturally impactful hits that aren't limited to a territory. This opens up whole new markets to the fast-growing businesses creators of all sizes are launching." —Marc Hustvedt, President at Mr Beast

Closing thoughts

The creator economy is not dying—it is just going through a cycle of consolidation. We still believe many of us will become creators in the future, and new types of innovation will take place that will create a new generation of creators and founders.

The coming year will be challenging for creators with brands cutting back on spending—more austere and uncertain conditions that are affecting founders across sectors. Raising capital today is more challenging than it was a year ago. At the same time, we are witnessing a number of incredibly exciting technologies that will hugely benefit the creator economy in the coming years. With the emergence of Generative AI, creators can now truly be global with the use of technologies that can turn content into any language, using the creator’s original voice.

If you're building the next generation of creator economy or Gen-AI platforms, we would love to meet you and learn more about your work. Let's shape the future together!

Thank you to the following creators who contributed towards the piece: Toba Courage, Elly Manuel, Lisa Baisl, Jorden Tually, Dulma Altan, Makena Quesada, Collin Abroadcast, Lucy MoonS, tar Holroyd, Aksh Baghla, Mallola Khalidi, Rebecca Rogers, Nuseir Yassin, Anela Malik, Anmol Sachar, Laurie Shannon, Mike Kruzich, Aisha Beau, Frisbey, Amanda Lee, Joshua Pieters, Zac Alsop, Elliot Simmons, Naser Al Azzeh, Maria Koutsogiannis, Kelsey Mac, Dermaid & Becky Wright, The Sorry Girls, Verna GaoH, unter Hill, Nisha Vora, Stephen Alexander, Valerie Lepelch, Riley Lemon, and Tiahra Nelson.

Good morning, can I translate part of this report into Spanish with links to you and a descripción of your newsletter?