Investing in the $100 billion creator economy

Insights to guide founders on their journey of building their creator economy platforms.

Two years ago, few investors were paying attention to the creator economy. Since the pandemic, the tables have turned completely. As more and more people are picking creator as a preferred career choice, very few investors today are not paying attention to this emerging category. Creators no longer need to hammer distribution through a studio; instead, they can do it from their back pocket. And this trend is just at its inception.

In this article, we look at the creator economy from our perspective as investors. Drawing from learnings we have gathered over time, we offer guidance to founders on what to expect when they start, grow, and scale their creator economy platforms. In addition, we cover protecting the creator economy through the recession, go-to-market strategies, what creators think about when shifting to new platforms, and much more.

Watch this video tutorial, read our in-depth analysis below, and view our related presentation.

The creator landscape

The creator landscape is still very new and changing every day. As of March 2022, only 15 creator economy platforms have reached unicorn status in the last three years. Still, the category is now worth over $100 billion—with 200 million creators part of it—and growing fast. Anyone can now become a creator, including the 29% of American students who selected it as their preferred career choice. Of course that means the space is becoming fiercely competitive.

In today’s creator economy, there are multiple types of creators ranging from music artists, podcasters, gamers, and those who are providing personal travel advice on platforms such as TikTok. All are regularly exploring options for how to monetize leveraging the range of platforms founders are building.

Where do I start as a founder building a platform to support creators?

Starting a creator platform is notoriously difficult. There are multiple players in this category, all with similar offerings and all fighting to grab creators’ attention. This is what we look for as investors when founders are looking to build companies in the creator space:

Obsession—do they have that absolute attachment to help creators in some capacity?

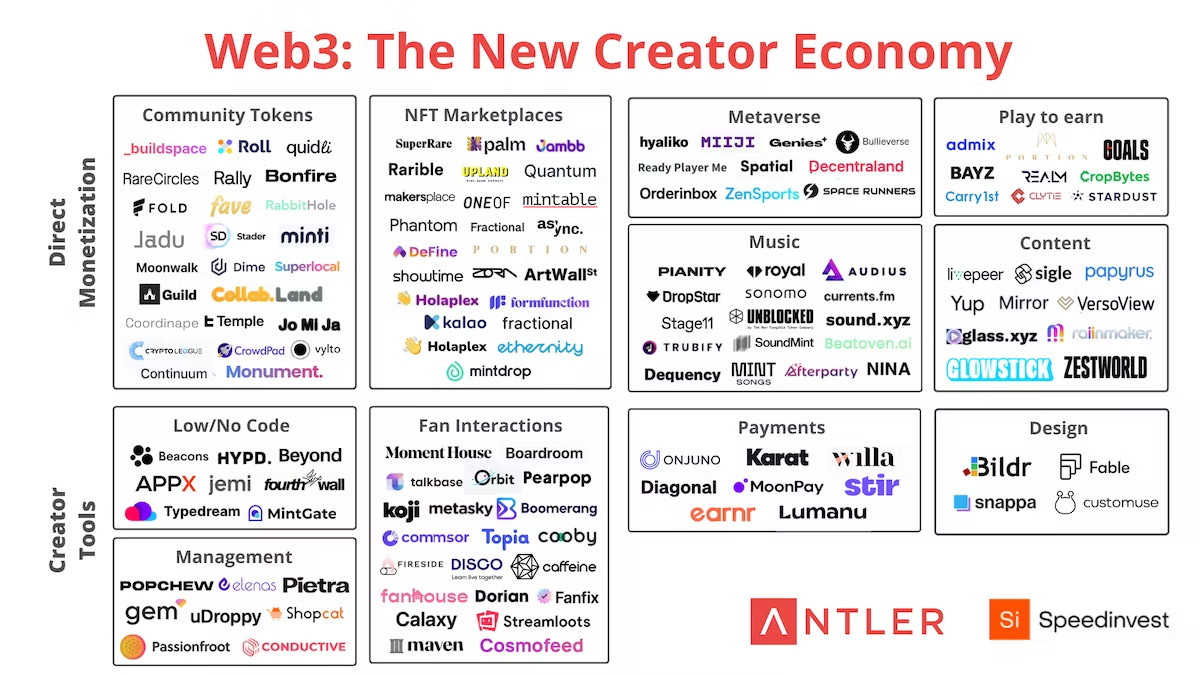

Are they looking to build in the Web2 or Web3 space? (More on this in our video above.)

Do they understand the creators’ true pain points without assuming what the pain points are?

Are they deeply ingrained in the space and can they easily access creators as they are hard to initially contact?

Are the founders chasing a large disruptive market? The creator economy is huge, so what are the founders disrupting that may have not been disrupted yet?

Attention vs. revenue—providing creators with distribution and a source of income

Now that there are more than 200 million creators globally, how do they think about monetizing? From our interactions with many creators, we have learned that they focus on two key factors: attention and revenue.

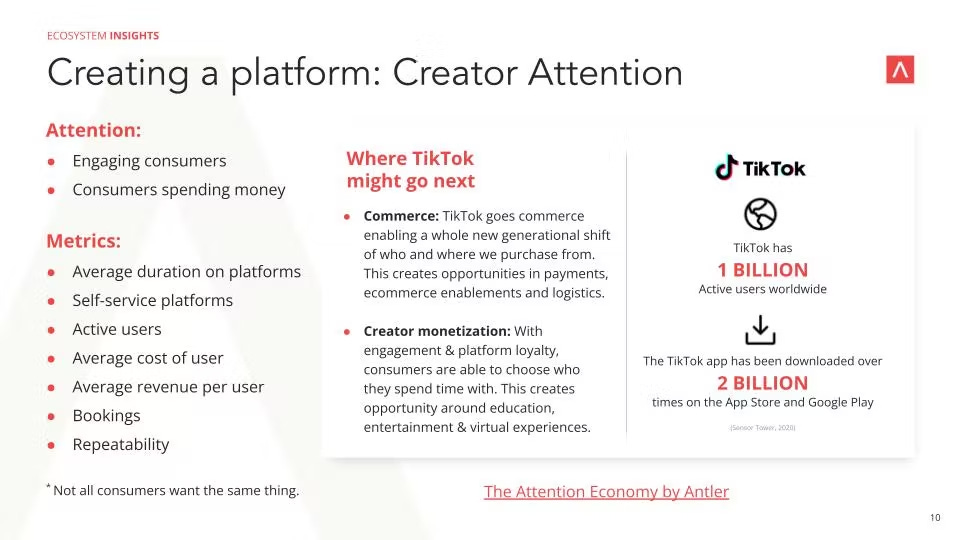

When we recently published The Attention Economy to understand how our attentions are shifting, one clear learning emerged: though our attentions are shortening, we care who we consume from. The same is true for creators. They want to grab our attention for as long as possible because, attention = revenue for creators.

On the other hand, platforms should consider the following key attention success metrics:

Average duration on platforms.

Are you building a self-service platform where you don’t have to tell the creators what to do?—e.g., YouTube and TikTok just provide the infrastructure, they are not telling creators what to post, although they might be providing recommendations.

Active users (daily, weekly, and monthly).

Average acquisition cost per user.

Bookings (mainly for marketplaces).

Revenue repeatability—how often are the users returning to the platform and how many of those are spending money?

Creators are not afraid to try new things. They want to break down barriers so offer plenty but a restricted number of new opportunities for them. Make them your biggest superfans. How many creators are referring fellow creators to your platform?

How long are creators spending on your platform and what does their distribution look like? Is it increasing because of your platform?

*If you can provide insane value for creators, they should stay with you.

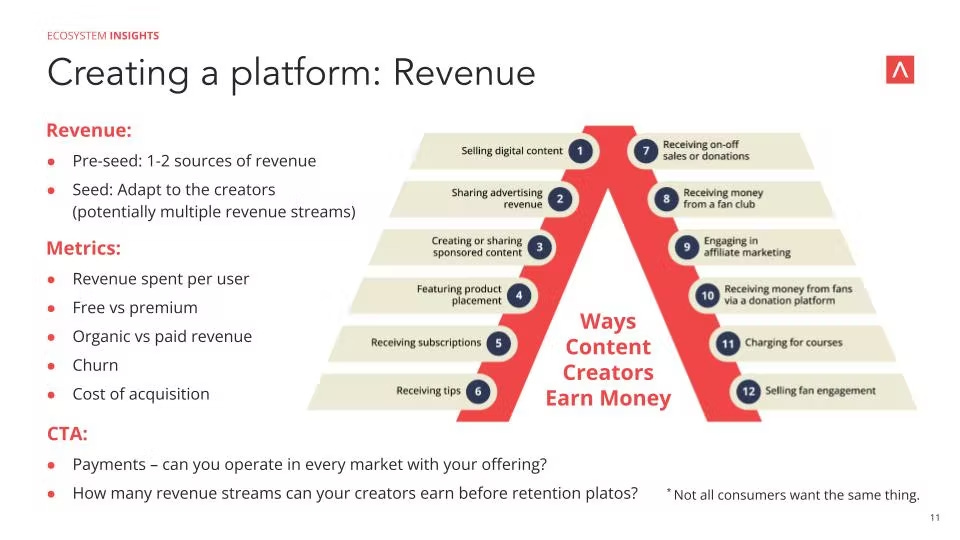

On the flip side, although creators need to have diverse incomes, it’s not recommended to go broad too early. As early-stage platforms, you should only be providing one or two revenue streams for the creator so you can focus on making the wheel spin and delivering value to the customer. As you start to grow, you should focus on adapting to the creators’ needs as they start to scale their individuality.

Two key questions to consider when building a creator platform:

1. Are you able to physically operate in all geographies?

2. How do you offer a platform that allows the creators to scale in all markets globally? For example, content platforms are only useful to creators in their spoken languages. Provide opportunities to be global-not-local players from day one.

If you do not pay creators, they will leave

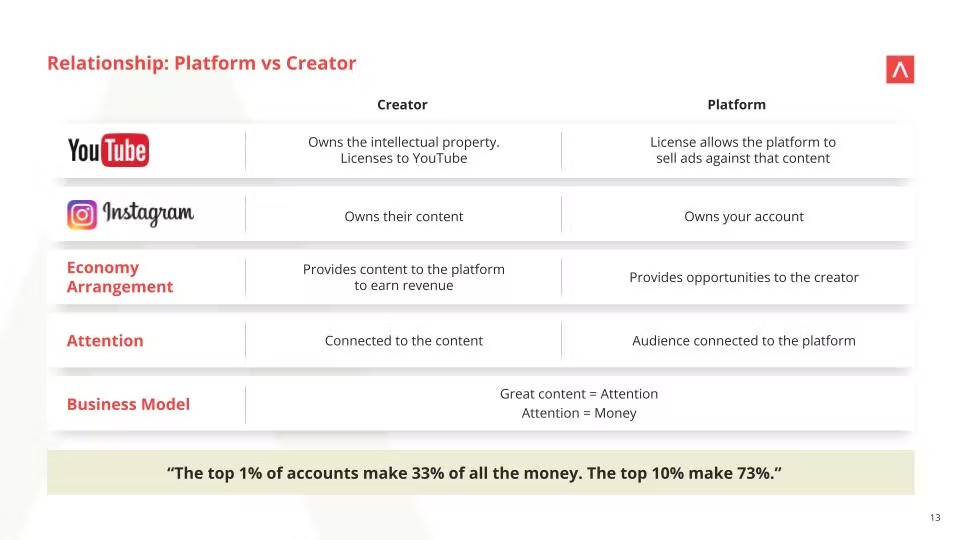

As you begin catering to multiple creators, always think about what your relationship is going to be with the creator. For example, YouTube allows you to post on a platform. While you own the intellectual property, they still have the rights to license your content, which allows them to sell ads against your content.

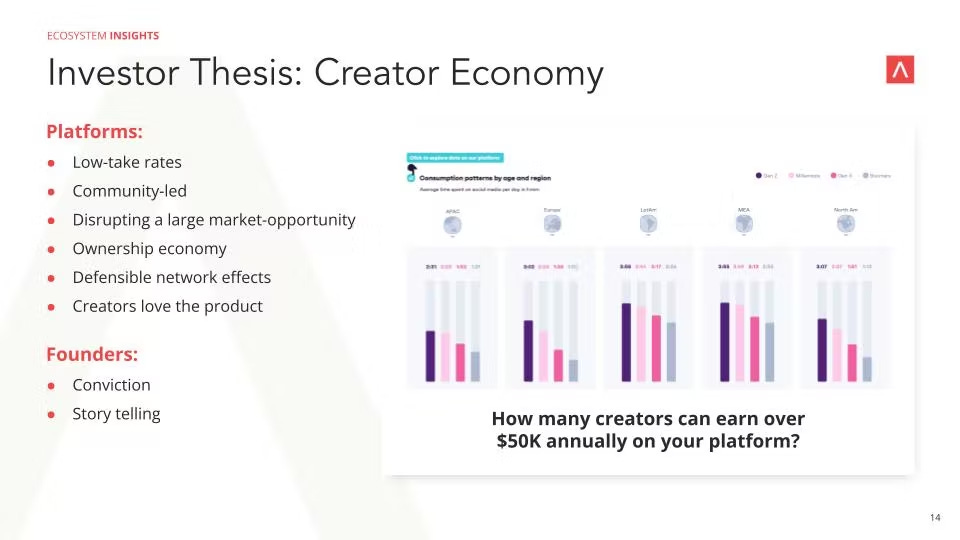

Similarly with Instagram, you own the content, but they own your account, meaning they can close it without your consent. The majority of the time, most creator platforms provide world-class infrastructures that allow their audience to be connected to the platform who will keep returning. As we pointed out earlier, great content equals attention. Attention equals revenue for the creator. The below slide demonstrates the creator economy thesis that investors want to see.

In summary: Are you providing creators with fair revenue streams (high take rates are very unfair to creators), will your platform be community led where the creators own the audience, are you disrupting a large market, is the product really needed by the creators, and finally, how will you build defensible network effects?

Features to build a scalable creator economy platform

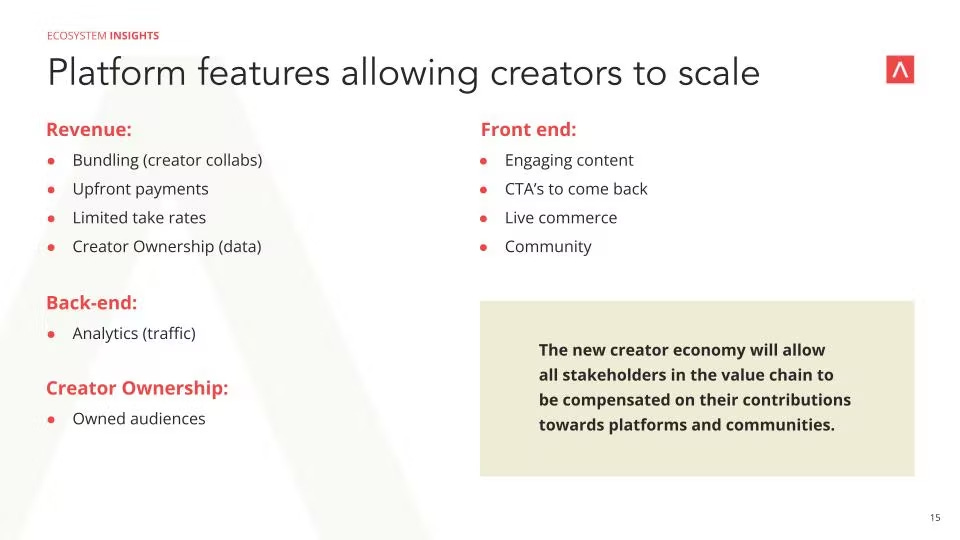

Building a scalable creator economy platform is incredibly tough. There are many platforms out there building similar concepts meaning how you stand apart from the competition will be your biggest competitive advantage. Today, we see platforms evolving to provide key features for creators to be global from day one.

Global from day one. Can you create software (language support) that allows creators to be global vs. local from day one?

Creator bundling. Creators love collaborating with creators who might have superfans in common. If you allow creators to bundle content together by saving their fans some money, this drives attention for both the consumer and the creator.

Limited take rates. In today's creator economy, you cannot charge 50% take rates. Seven percent seems reasonable, 10-12.5% with discoverability and payments included.

The New Creator Economy. Allow your creators to own the data of their fans through your platform.

Community. Allow your creators to connect and interact with their fans via your platform.

Experience. As the product improves, you should hopefully have more users joining and returning with network effects, creating defensibility.

Additional revenue streams. Enable creators to further establish themselves through community engagement and further revenue streams such as community tokens, NFTs, live shopping, and more.

Creator revenues: supporting creators to survive and thrive

The top 1% of creators earn most of the revenue in the creator economy—-but the creator middle classes are quickly catching up.

When building a company in this space, it’s all about creator acquisition early on that can be achieved through partnerships, complimentary collaborations with fellow creator economy platforms, and community. Being a creator is incredibly hard and some work night and day yet hardly earn an income for years. So thinking about how you can support creators to survive is also a factor to consider. Remember, creators just need 100 true fans to earn a liveable income. If your platform can do that, you are potentially on the path to supporting thousands if not millions of creators.

When a creator is in the earliest days, we see platforms supporting them by:

Going the extra mile in helping them find their 100 true fans.

Enabling them to connect with their fans.

Providing compensation for any creators referred to the platform.

Personal touches such as regular touch points with the creators.

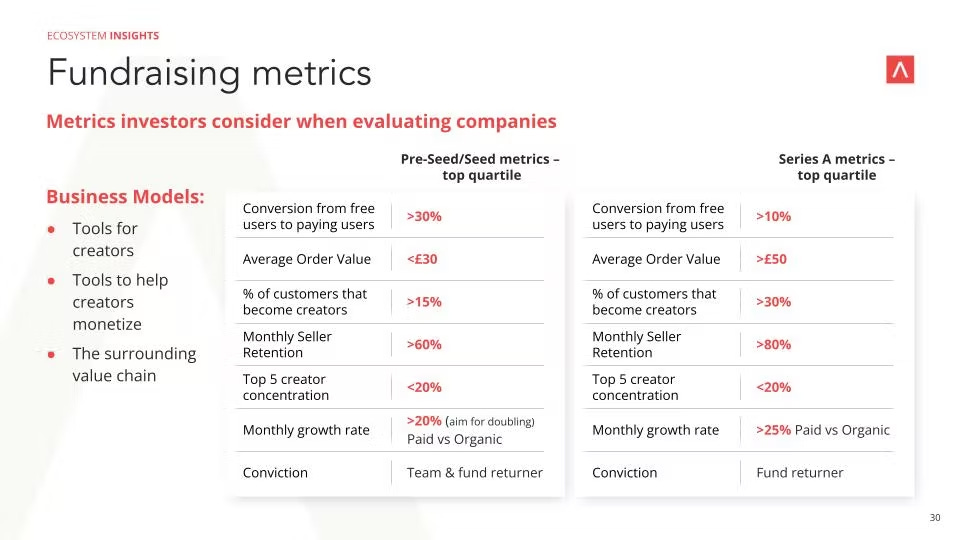

Fundraising metrics: what to prepare when you go out and raise

Always remember: every investor will want to meet you as they don’t want to miss on a potential fund returner (a company that returns the entire size of the fund).

When the time comes to raise capital, it might feel incredibly exciting but be warned, it will not be easy. Fundamentally, at the earliest stages of investing, everything comes down to the team and the current market. (The creator economy is hot right now.)

What should you prepare when you go out to raise?

During your first meeting, you will most likely be asked the following questions:

Why are you building in this space?

What’s your defensibility?

How do you plan to take your product to market and what are your short-/long-term go-to-market strategies?

What is your vision?

If investors are interested in talking further, they will schedule another call with you. Pro tip: aim to secure investor meetings on Wednesdays or Thursdays. Investment Committees (where they discuss the companies they met in the previous week), typically take place every Monday.

Even more importantly, remember you are in the driver’s seat so it’s important to ask smart and tactical questions about why you want these investors to partner with you.

Here are some recommended questions to ask:

Where do you see the creator economy going? Don’t forget, these investors meet many founders daily who are building in the space so they will have most likely collected a lot of knowledge.

Why are you excited about the space and what are the current challenges faced by creators you have spoken to? Here you are trying to identify if these investors: a) have a good understanding of creators pain points, and b) have a creator network.

Investors will sometimes ask, “How can I be helpful?” Ask them to introduce creators to you if they can.

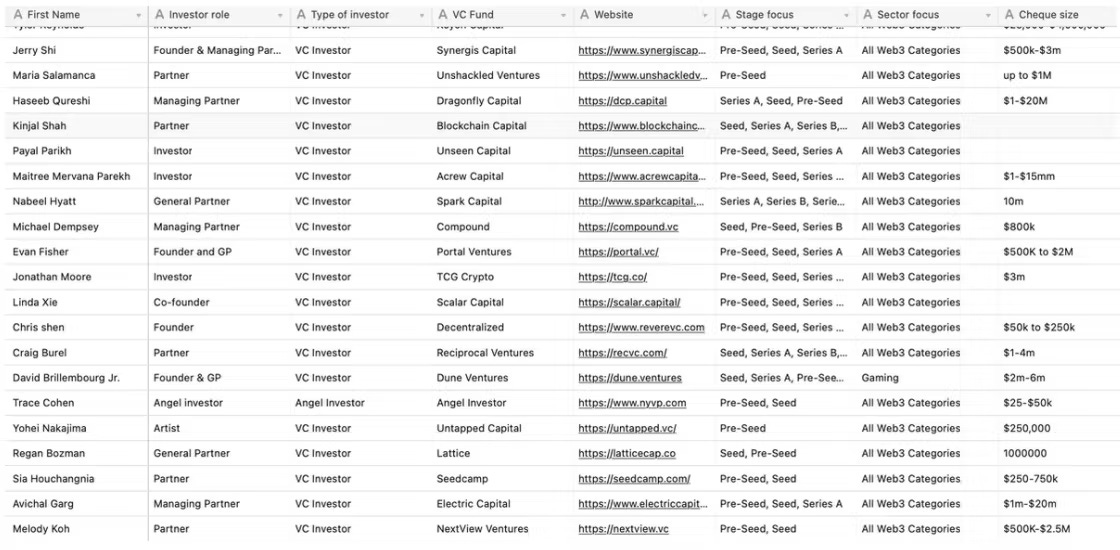

There are three types of capital you can go after when building pre-Series B: Creators, Angels, and VCs as well as your community. We highly recommend you attempt to have creators on your cap table as they will know many creators who they can introduce you to. The typical investment process takes anywhere from 3-12 months.

Creator business models are shifting

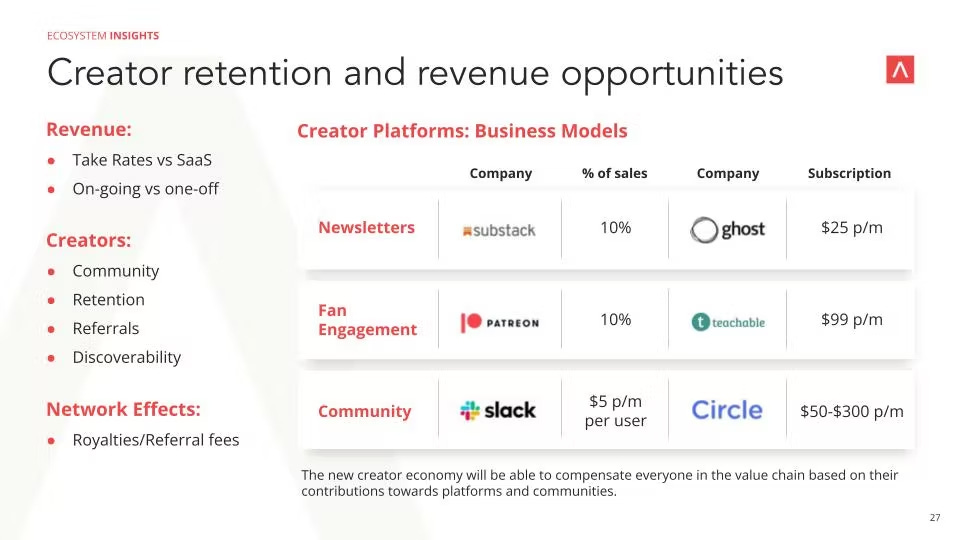

As the creator economy has evolved, we have seen platforms proactively establishing one core revenue stream—either a take rate (percentage of creators’ earnings) or a monthly subscription fee.

As the creator economy enters Web3, platforms are becoming more transparent and handing the power to the creator. The platforms today who go down the take rate route to the creator, will unlikely continue to charge their top 1% of creators the same amount, as they will pick up and leave for a different platform.

Consider this example:

Creator A has a subscription service for their weekly newsletter. They start on Substack that charges a 10% subscription fee but the newsletter quickly becomes popular and rises to 10,000 subscribers, all paying $10 per month. Substack charges a 10% take rate for any subscription paid on their platform (which is $10,000 a month, of the creators’ $100K monthly subscription business). Substack does not provide any discoverability to the creator, they just provide the infrastructure. As Creator A starts to think about how they can earn extra money, they go to a similar subscription infrastructure business, Ghost, that charges just $300 a year for creators to use their infrastructure. The creator is now earning almost an additional $120K a year.

As new types of platforms emerge, we are witnessing three key shifts:

Take rates are being massively reduced to under 12%.

Take rates can rise based on the customers they bring to the creators. For example, if you build out a solid algorithm that brings an additional 100 customers to creators a month, you could charge 20% take rates for those 100 customers you bought the creator.

Historically one-sided platforms are becoming two-sided marketplaces based on the data they have. However, all of this data is brought to the platform from all the creators’ hard work. (The creators have used their fame to bring all of their fans to subscribe to their services, on their chosen platforms, providing the platforms with free marketing.) We may see platforms building out two-sided marketplaces while compensating the original creators who brought the additional creators—and the money they spend—to their platforms.